Quick filters:

Inflation target Stock Photos and Images

File photo dated 21/09/23 of the Bank of England, London. The Bank of England should be given the power to cut interest rates into negative territory and take steps towards a higher inflation target to help future-proof the nation's finances in the event of further crises, according to a report. Issue date: Thursday October 19, 2023. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-photo-dated-210923-of-the-bank-of-england-london-the-bank-of-england-should-be-given-the-power-to-cut-interest-rates-into-negative-territory-and-take-steps-towards-a-higher-inflation-target-to-help-future-proof-the-nations-finances-in-the-event-of-further-crises-according-to-a-report-issue-date-thursday-october-19-2023-image569471636.html

File photo dated 21/09/23 of the Bank of England, London. The Bank of England should be given the power to cut interest rates into negative territory and take steps towards a higher inflation target to help future-proof the nation's finances in the event of further crises, according to a report. Issue date: Thursday October 19, 2023. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-photo-dated-210923-of-the-bank-of-england-london-the-bank-of-england-should-be-given-the-power-to-cut-interest-rates-into-negative-territory-and-take-steps-towards-a-higher-inflation-target-to-help-future-proof-the-nations-finances-in-the-event-of-further-crises-according-to-a-report-issue-date-thursday-october-19-2023-image569471636.htmlRM2T2DJTM–File photo dated 21/09/23 of the Bank of England, London. The Bank of England should be given the power to cut interest rates into negative territory and take steps towards a higher inflation target to help future-proof the nation's finances in the event of further crises, according to a report. Issue date: Thursday October 19, 2023.

Toronto, Canada. 17th Sep, 2024. Customers shop at a market in Toronto, Canada, on Sept. 17, 2024. Canada's Consumer Price Index (CPI) rose 2 percent on a year-over-year basis in August, back to the inflation target set by the Bank of Canada, Statistics Canada said Tuesday. Credit: Zou Zheng/Xinhua/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/toronto-canada-17th-sep-2024-customers-shop-at-a-market-in-toronto-canada-on-sept-17-2024-canadas-consumer-price-index-cpi-rose-2-percent-on-a-year-over-year-basis-in-august-back-to-the-inflation-target-set-by-the-bank-of-canada-statistics-canada-said-tuesday-credit-zou-zhengxinhuaalamy-live-news-image622329716.html

Toronto, Canada. 17th Sep, 2024. Customers shop at a market in Toronto, Canada, on Sept. 17, 2024. Canada's Consumer Price Index (CPI) rose 2 percent on a year-over-year basis in August, back to the inflation target set by the Bank of Canada, Statistics Canada said Tuesday. Credit: Zou Zheng/Xinhua/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/toronto-canada-17th-sep-2024-customers-shop-at-a-market-in-toronto-canada-on-sept-17-2024-canadas-consumer-price-index-cpi-rose-2-percent-on-a-year-over-year-basis-in-august-back-to-the-inflation-target-set-by-the-bank-of-canada-statistics-canada-said-tuesday-credit-zou-zhengxinhuaalamy-live-news-image622329716.htmlRM2Y4DFW8–Toronto, Canada. 17th Sep, 2024. Customers shop at a market in Toronto, Canada, on Sept. 17, 2024. Canada's Consumer Price Index (CPI) rose 2 percent on a year-over-year basis in August, back to the inflation target set by the Bank of Canada, Statistics Canada said Tuesday. Credit: Zou Zheng/Xinhua/Alamy Live News

One person is answering question about inflation target. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/one-person-is-answering-question-about-inflation-target-image382667550.html

One person is answering question about inflation target. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/one-person-is-answering-question-about-inflation-target-image382667550.htmlRF2D6G0A6–One person is answering question about inflation target.

210709 -- FRANKFURT, July 9, 2021 -- European Central Bank ECB President Christine Lagarde C speaks during a press conference on the results of the ECB strategy review held at the ECB headquarters in Frankfurt, Germany, on July 8, 2021. The European Central Bank said on Thursday that it has approved a new monetary policy strategy that adopts symmetric 2 percent inflation target over the medium term.FOR EDITORIAL USE ONLY. NOT FOR SALE FOR MARKETING OR ADVERTISING CAMPAIGNS. European Central Bank/Handout via Xinhua GERMANY-FRANKFURT-ECB-STRATEGY REVIEW LuxYang PUBLICATIONxNOTxINxCHN Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/210709-frankfurt-july-9-2021-european-central-bank-ecb-president-christine-lagarde-c-speaks-during-a-press-conference-on-the-results-of-the-ecb-strategy-review-held-at-the-ecb-headquarters-in-frankfurt-germany-on-july-8-2021-the-european-central-bank-said-on-thursday-that-it-has-approved-a-new-monetary-policy-strategy-that-adopts-symmetric-2-percent-inflation-target-over-the-medium-termfor-editorial-use-only-not-for-sale-for-marketing-or-advertising-campaigns-european-central-bankhandout-via-xinhua-germany-frankfurt-ecb-strategy-review-luxyang-publicationxnotxinxchn-image565088925.html

210709 -- FRANKFURT, July 9, 2021 -- European Central Bank ECB President Christine Lagarde C speaks during a press conference on the results of the ECB strategy review held at the ECB headquarters in Frankfurt, Germany, on July 8, 2021. The European Central Bank said on Thursday that it has approved a new monetary policy strategy that adopts symmetric 2 percent inflation target over the medium term.FOR EDITORIAL USE ONLY. NOT FOR SALE FOR MARKETING OR ADVERTISING CAMPAIGNS. European Central Bank/Handout via Xinhua GERMANY-FRANKFURT-ECB-STRATEGY REVIEW LuxYang PUBLICATIONxNOTxINxCHN Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/210709-frankfurt-july-9-2021-european-central-bank-ecb-president-christine-lagarde-c-speaks-during-a-press-conference-on-the-results-of-the-ecb-strategy-review-held-at-the-ecb-headquarters-in-frankfurt-germany-on-july-8-2021-the-european-central-bank-said-on-thursday-that-it-has-approved-a-new-monetary-policy-strategy-that-adopts-symmetric-2-percent-inflation-target-over-the-medium-termfor-editorial-use-only-not-for-sale-for-marketing-or-advertising-campaigns-european-central-bankhandout-via-xinhua-germany-frankfurt-ecb-strategy-review-luxyang-publicationxnotxinxchn-image565088925.htmlRM2RRA0K9–210709 -- FRANKFURT, July 9, 2021 -- European Central Bank ECB President Christine Lagarde C speaks during a press conference on the results of the ECB strategy review held at the ECB headquarters in Frankfurt, Germany, on July 8, 2021. The European Central Bank said on Thursday that it has approved a new monetary policy strategy that adopts symmetric 2 percent inflation target over the medium term.FOR EDITORIAL USE ONLY. NOT FOR SALE FOR MARKETING OR ADVERTISING CAMPAIGNS. European Central Bank/Handout via Xinhua GERMANY-FRANKFURT-ECB-STRATEGY REVIEW LuxYang PUBLICATIONxNOTxINxCHN

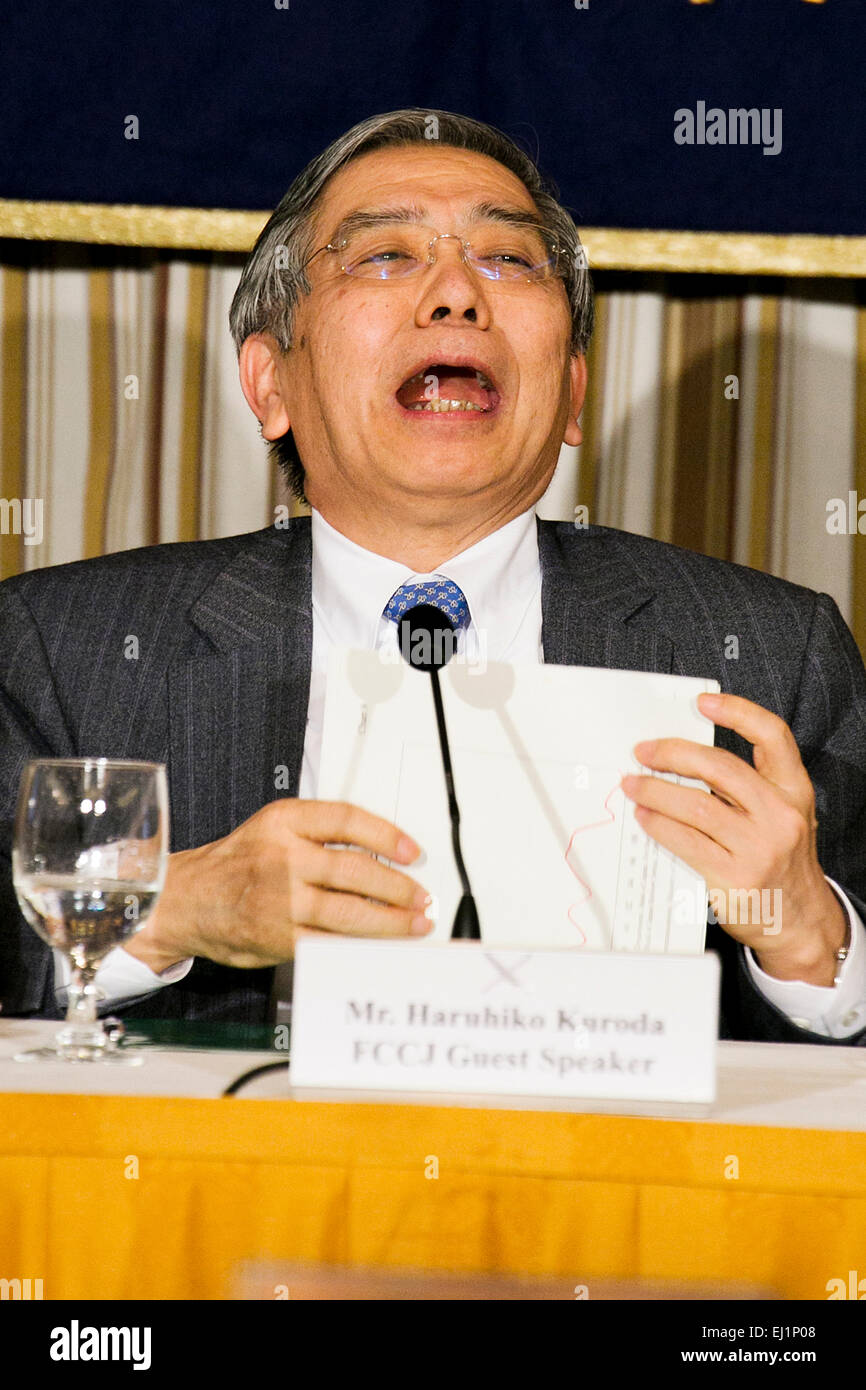

Haruhiko Kuroda, Governor of the Bank of Japan (BOJ) speaks during a press conference at the Foreign Correspondents' Club of Japan on March 20, 2015, Tokyo, Japan. Kuroda spoke about the challenges facing Japan's economy and Bank's policy measures to protect the economy. He also discussed inflation expectations that help to prevent the economy from falling into deflation. The Governor said on Thursday in a parliamentary address that BOJ bond purchases were aimed at hitting the 2 percent inflation target, and not at bankrolling public debt. Credit: Rodrigo Reyes Marin/AFLO/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-haruhiko-kuroda-governor-of-the-bank-of-japan-boj-speaks-during-a-79944488.html

Haruhiko Kuroda, Governor of the Bank of Japan (BOJ) speaks during a press conference at the Foreign Correspondents' Club of Japan on March 20, 2015, Tokyo, Japan. Kuroda spoke about the challenges facing Japan's economy and Bank's policy measures to protect the economy. He also discussed inflation expectations that help to prevent the economy from falling into deflation. The Governor said on Thursday in a parliamentary address that BOJ bond purchases were aimed at hitting the 2 percent inflation target, and not at bankrolling public debt. Credit: Rodrigo Reyes Marin/AFLO/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-haruhiko-kuroda-governor-of-the-bank-of-japan-boj-speaks-during-a-79944488.htmlRMEJ1P08–Haruhiko Kuroda, Governor of the Bank of Japan (BOJ) speaks during a press conference at the Foreign Correspondents' Club of Japan on March 20, 2015, Tokyo, Japan. Kuroda spoke about the challenges facing Japan's economy and Bank's policy measures to protect the economy. He also discussed inflation expectations that help to prevent the economy from falling into deflation. The Governor said on Thursday in a parliamentary address that BOJ bond purchases were aimed at hitting the 2 percent inflation target, and not at bankrolling public debt. Credit: Rodrigo Reyes Marin/AFLO/Alamy Live News

London, UK. 30th Aug, 2023. The Bank of England (left) in the City of London. The Bank's chief economist, Huw Pill has indicated that further interest rate rises may be used to reach their takget inflation rate of 2%. Inflation in the UK current'y stands at 6.8%. Credit: Anna Watson/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-30th-aug-2023-the-bank-of-england-left-in-the-city-of-london-the-banks-chief-economist-huw-pill-has-indicated-that-further-interest-rate-rises-may-be-used-to-reach-their-takget-inflation-rate-of-2-inflation-in-the-uk-currenty-stands-at-68-credit-anna-watsonalamy-live-news-image563698984.html

London, UK. 30th Aug, 2023. The Bank of England (left) in the City of London. The Bank's chief economist, Huw Pill has indicated that further interest rate rises may be used to reach their takget inflation rate of 2%. Inflation in the UK current'y stands at 6.8%. Credit: Anna Watson/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-30th-aug-2023-the-bank-of-england-left-in-the-city-of-london-the-banks-chief-economist-huw-pill-has-indicated-that-further-interest-rate-rises-may-be-used-to-reach-their-takget-inflation-rate-of-2-inflation-in-the-uk-currenty-stands-at-68-credit-anna-watsonalamy-live-news-image563698984.htmlRM2RN2KPG–London, UK. 30th Aug, 2023. The Bank of England (left) in the City of London. The Bank's chief economist, Huw Pill has indicated that further interest rate rises may be used to reach their takget inflation rate of 2%. Inflation in the UK current'y stands at 6.8%. Credit: Anna Watson/Alamy Live News

London, UK. 26th Jan, 2022. Protesters target Downing Street as Boris Johnson faces further demands to resign during Prime Ministers Questions due to ‘Partygate' and the highest rate of inflation for 30 years. 26th January 2022, Whitehall, London, England, UK Credit: Jeff Gilbert/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-26th-jan-2022-protesters-target-downing-street-as-boris-johnson-faces-further-demands-to-resign-during-prime-ministers-questions-due-to-partygate-and-the-highest-rate-of-inflation-for-30-years-26th-january-2022-whitehall-london-england-uk-credit-jeff-gilbertalamy-live-news-image458582903.html

London, UK. 26th Jan, 2022. Protesters target Downing Street as Boris Johnson faces further demands to resign during Prime Ministers Questions due to ‘Partygate' and the highest rate of inflation for 30 years. 26th January 2022, Whitehall, London, England, UK Credit: Jeff Gilbert/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-26th-jan-2022-protesters-target-downing-street-as-boris-johnson-faces-further-demands-to-resign-during-prime-ministers-questions-due-to-partygate-and-the-highest-rate-of-inflation-for-30-years-26th-january-2022-whitehall-london-england-uk-credit-jeff-gilbertalamy-live-news-image458582903.htmlRM2HJ274R–London, UK. 26th Jan, 2022. Protesters target Downing Street as Boris Johnson faces further demands to resign during Prime Ministers Questions due to ‘Partygate' and the highest rate of inflation for 30 years. 26th January 2022, Whitehall, London, England, UK Credit: Jeff Gilbert/Alamy Live News

Shopping in a Whole Foods Market supermarket in New York on Wednesday, June 29, 2022. The Federal Reserve announced that it will continue to raise interest rates until it sees proof that inflation slows down to their target level, 2%. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-in-a-whole-foods-market-supermarket-in-new-york-on-wednesday-june-29-2022-the-federal-reserve-announced-that-it-will-continue-to-raise-interest-rates-until-it-sees-proof-that-inflation-slows-down-to-their-target-level-2-richard-b-levine-image474607933.html

Shopping in a Whole Foods Market supermarket in New York on Wednesday, June 29, 2022. The Federal Reserve announced that it will continue to raise interest rates until it sees proof that inflation slows down to their target level, 2%. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-in-a-whole-foods-market-supermarket-in-new-york-on-wednesday-june-29-2022-the-federal-reserve-announced-that-it-will-continue-to-raise-interest-rates-until-it-sees-proof-that-inflation-slows-down-to-their-target-level-2-richard-b-levine-image474607933.htmlRM2JG4779–Shopping in a Whole Foods Market supermarket in New York on Wednesday, June 29, 2022. The Federal Reserve announced that it will continue to raise interest rates until it sees proof that inflation slows down to their target level, 2%. (© Richard B. Levine)

Shopping in a Whole Foods Market supermarket in New York on Wednesday, August 30, 2023. The Personal Consumption Expenditures index, a gauge used to judge inflation, is reported to have climbed 3.3 percent, above the Fed’s 2 percent target. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-in-a-whole-foods-market-supermarket-in-new-york-on-wednesday-august-30-2023-the-personal-consumption-expenditures-index-a-gauge-used-to-judge-inflation-is-reported-to-have-climbed-33-percent-above-the-feds-2-percent-target-richard-b-levine-image565274122.html

Shopping in a Whole Foods Market supermarket in New York on Wednesday, August 30, 2023. The Personal Consumption Expenditures index, a gauge used to judge inflation, is reported to have climbed 3.3 percent, above the Fed’s 2 percent target. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-in-a-whole-foods-market-supermarket-in-new-york-on-wednesday-august-30-2023-the-personal-consumption-expenditures-index-a-gauge-used-to-judge-inflation-is-reported-to-have-climbed-33-percent-above-the-feds-2-percent-target-richard-b-levine-image565274122.htmlRM2RRJCWE–Shopping in a Whole Foods Market supermarket in New York on Wednesday, August 30, 2023. The Personal Consumption Expenditures index, a gauge used to judge inflation, is reported to have climbed 3.3 percent, above the Fed’s 2 percent target. (© Richard B. Levine)

London, UK. 7 November 2024 A view of the Bank of England in Threadneedle street this morning. The Monetary committee of the Bank of England has decided to lower interest rates from 5- 4.75 percent after meeting the inflation target.Credit.Amer Ghazzal/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-7-november-2024-a-view-of-the-bank-of-england-in-threadneedle-street-this-morning-the-monetary-committee-of-the-bank-of-england-has-decided-to-lower-interest-rates-from-5-475-percent-after-meeting-the-inflation-targetcreditamer-ghazzalalamy-live-news-image629722966.html

London, UK. 7 November 2024 A view of the Bank of England in Threadneedle street this morning. The Monetary committee of the Bank of England has decided to lower interest rates from 5- 4.75 percent after meeting the inflation target.Credit.Amer Ghazzal/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-7-november-2024-a-view-of-the-bank-of-england-in-threadneedle-street-this-morning-the-monetary-committee-of-the-bank-of-england-has-decided-to-lower-interest-rates-from-5-475-percent-after-meeting-the-inflation-targetcreditamer-ghazzalalamy-live-news-image629722966.htmlRM2YGEA1X–London, UK. 7 November 2024 A view of the Bank of England in Threadneedle street this morning. The Monetary committee of the Bank of England has decided to lower interest rates from 5- 4.75 percent after meeting the inflation target.Credit.Amer Ghazzal/Alamy Live News

'Bank holds interest rates but hints at cut in June as it says inflation set to hit 2% target' Guardian newspaper headline Bank of England 10 May 2024 Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/bank-holds-interest-rates-but-hints-at-cut-in-june-as-it-says-inflation-set-to-hit-2-target-guardian-newspaper-headline-bank-of-england-10-may-2024-image606764917.html

'Bank holds interest rates but hints at cut in June as it says inflation set to hit 2% target' Guardian newspaper headline Bank of England 10 May 2024 Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/bank-holds-interest-rates-but-hints-at-cut-in-june-as-it-says-inflation-set-to-hit-2-target-guardian-newspaper-headline-bank-of-england-10-may-2024-image606764917.htmlRM2X74ERH–'Bank holds interest rates but hints at cut in June as it says inflation set to hit 2% target' Guardian newspaper headline Bank of England 10 May 2024

Abandoned Target shopping cart in a parking lot Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/abandoned-target-shopping-cart-in-a-parking-lot-image562789385.html

Abandoned Target shopping cart in a parking lot Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/abandoned-target-shopping-cart-in-a-parking-lot-image562789385.htmlRF2RKH7GW–Abandoned Target shopping cart in a parking lot

FED or Federal Reserve control interest rates raise or lower concept. Wooden blocks with text and arrows. Copy space Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/fed-or-federal-reserve-control-interest-rates-raise-or-lower-concept-wooden-blocks-with-text-and-arrows-copy-space-image592318640.html

FED or Federal Reserve control interest rates raise or lower concept. Wooden blocks with text and arrows. Copy space Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/fed-or-federal-reserve-control-interest-rates-raise-or-lower-concept-wooden-blocks-with-text-and-arrows-copy-space-image592318640.htmlRF2WBJCD4–FED or Federal Reserve control interest rates raise or lower concept. Wooden blocks with text and arrows. Copy space

Crash target concept Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/crash-target-concept-image343623725.html

Crash target concept Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/crash-target-concept-image343623725.htmlRM2AY1BFW–Crash target concept

Recession slump target Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/recession-slump-target-image547788670.html

Recession slump target Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/recession-slump-target-image547788670.htmlRF2PR5X12–Recession slump target

Business Grant Management. Future Target And Health Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/business-grant-management-future-target-and-health-image469088609.html

Business Grant Management. Future Target And Health Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/business-grant-management-future-target-and-health-image469088609.htmlRF2J74R8H–Business Grant Management. Future Target And Health

London, UK. 2 August 2023. The exterior of the Bank of England. In an attempt to curb inflation the monetary policy committee (MPC) of the Bank of England is expected to announce an increase in the base rate from 5.00% to 5.25%, though some speculate a rise to 5.5%. It would be the 14th consecutive increase, as the MPC tries to bring inflation down towards its 2 per cent target. A rise in the interest rate will make borrowing more expensive and deter spending. Credit: Stephen Chung / Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-2-august-2023-the-exterior-of-the-bank-of-england-in-an-attempt-to-curb-inflation-the-monetary-policy-committee-mpc-of-the-bank-of-england-is-expected-to-announce-an-increase-in-the-base-rate-from-500-to-525-though-some-speculate-a-rise-to-55-it-would-be-the-14th-consecutive-increase-as-the-mpc-tries-to-bring-inflation-down-towards-its-2-per-cent-target-a-rise-in-the-interest-rate-will-make-borrowing-more-expensive-and-deter-spending-credit-stephen-chung-alamy-live-news-image560200199.html

London, UK. 2 August 2023. The exterior of the Bank of England. In an attempt to curb inflation the monetary policy committee (MPC) of the Bank of England is expected to announce an increase in the base rate from 5.00% to 5.25%, though some speculate a rise to 5.5%. It would be the 14th consecutive increase, as the MPC tries to bring inflation down towards its 2 per cent target. A rise in the interest rate will make borrowing more expensive and deter spending. Credit: Stephen Chung / Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-2-august-2023-the-exterior-of-the-bank-of-england-in-an-attempt-to-curb-inflation-the-monetary-policy-committee-mpc-of-the-bank-of-england-is-expected-to-announce-an-increase-in-the-base-rate-from-500-to-525-though-some-speculate-a-rise-to-55-it-would-be-the-14th-consecutive-increase-as-the-mpc-tries-to-bring-inflation-down-towards-its-2-per-cent-target-a-rise-in-the-interest-rate-will-make-borrowing-more-expensive-and-deter-spending-credit-stephen-chung-alamy-live-news-image560200199.htmlRM2RFB91Y–London, UK. 2 August 2023. The exterior of the Bank of England. In an attempt to curb inflation the monetary policy committee (MPC) of the Bank of England is expected to announce an increase in the base rate from 5.00% to 5.25%, though some speculate a rise to 5.5%. It would be the 14th consecutive increase, as the MPC tries to bring inflation down towards its 2 per cent target. A rise in the interest rate will make borrowing more expensive and deter spending. Credit: Stephen Chung / Alamy Live News

Wooden block cube 2024 on coins stacking for setup objective target business cost and budget planning of new year concept. Money saving ideas and fina Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/wooden-block-cube-2024-on-coins-stacking-for-setup-objective-target-business-cost-and-budget-planning-of-new-year-concept-money-saving-ideas-and-fina-image614256391.html

Wooden block cube 2024 on coins stacking for setup objective target business cost and budget planning of new year concept. Money saving ideas and fina Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/wooden-block-cube-2024-on-coins-stacking-for-setup-objective-target-business-cost-and-budget-planning-of-new-year-concept-money-saving-ideas-and-fina-image614256391.htmlRF2XK9P87–Wooden block cube 2024 on coins stacking for setup objective target business cost and budget planning of new year concept. Money saving ideas and fina

Bank of England. London, UK. 1st Nov, 2017. A general view of the outside the Bank of England (BOE) in the city. The Monetary Policy Committee (MPC) may raise interest rates on Thursday 2 November 2017 for the first time in more than a decade from 0.25% to 0.5%. The Bank's Monetary Policy Committee sets interest rates to meet the Government's 2% inflation target. According to the ratings agency Moody's the property prices would not be greatly affected as the market remains resilient. Credit: Dinendra Haria/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-image-bank-of-england-london-uk-1st-nov-2017-a-general-view-of-the-outside-164681593.html

Bank of England. London, UK. 1st Nov, 2017. A general view of the outside the Bank of England (BOE) in the city. The Monetary Policy Committee (MPC) may raise interest rates on Thursday 2 November 2017 for the first time in more than a decade from 0.25% to 0.5%. The Bank's Monetary Policy Committee sets interest rates to meet the Government's 2% inflation target. According to the ratings agency Moody's the property prices would not be greatly affected as the market remains resilient. Credit: Dinendra Haria/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-image-bank-of-england-london-uk-1st-nov-2017-a-general-view-of-the-outside-164681593.htmlRMKFWW1D–Bank of England. London, UK. 1st Nov, 2017. A general view of the outside the Bank of England (BOE) in the city. The Monetary Policy Committee (MPC) may raise interest rates on Thursday 2 November 2017 for the first time in more than a decade from 0.25% to 0.5%. The Bank's Monetary Policy Committee sets interest rates to meet the Government's 2% inflation target. According to the ratings agency Moody's the property prices would not be greatly affected as the market remains resilient. Credit: Dinendra Haria/Alamy Live News

File photo dated 20/09/19 of the Bank of England, in the City of London. Business Secretary Kwasi Kwarteng has said it is clearly an issue that the Bank of England is failing to meet its inflation target. Issue date: Sunday May 15, 2022. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-photo-dated-200919-of-the-bank-of-england-in-the-city-of-london-business-secretary-kwasi-kwarteng-has-said-it-is-clearly-an-issue-that-the-bank-of-england-is-failing-to-meet-its-inflation-target-issue-date-sunday-may-15-2022-image469872591.html

File photo dated 20/09/19 of the Bank of England, in the City of London. Business Secretary Kwasi Kwarteng has said it is clearly an issue that the Bank of England is failing to meet its inflation target. Issue date: Sunday May 15, 2022. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-photo-dated-200919-of-the-bank-of-england-in-the-city-of-london-business-secretary-kwasi-kwarteng-has-said-it-is-clearly-an-issue-that-the-bank-of-england-is-failing-to-meet-its-inflation-target-issue-date-sunday-may-15-2022-image469872591.htmlRM2J8CF7Y–File photo dated 20/09/19 of the Bank of England, in the City of London. Business Secretary Kwasi Kwarteng has said it is clearly an issue that the Bank of England is failing to meet its inflation target. Issue date: Sunday May 15, 2022.

Toronto, Canada. 17th Sep, 2024. Customers shop for groceries at a market in Toronto, Canada, on Sept. 17, 2024. Canada's Consumer Price Index (CPI) rose 2 percent on a year-over-year basis in August, back to the inflation target set by the Bank of Canada, Statistics Canada said Tuesday. Credit: Zou Zheng/Xinhua/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/toronto-canada-17th-sep-2024-customers-shop-for-groceries-at-a-market-in-toronto-canada-on-sept-17-2024-canadas-consumer-price-index-cpi-rose-2-percent-on-a-year-over-year-basis-in-august-back-to-the-inflation-target-set-by-the-bank-of-canada-statistics-canada-said-tuesday-credit-zou-zhengxinhuaalamy-live-news-image622329714.html

Toronto, Canada. 17th Sep, 2024. Customers shop for groceries at a market in Toronto, Canada, on Sept. 17, 2024. Canada's Consumer Price Index (CPI) rose 2 percent on a year-over-year basis in August, back to the inflation target set by the Bank of Canada, Statistics Canada said Tuesday. Credit: Zou Zheng/Xinhua/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/toronto-canada-17th-sep-2024-customers-shop-for-groceries-at-a-market-in-toronto-canada-on-sept-17-2024-canadas-consumer-price-index-cpi-rose-2-percent-on-a-year-over-year-basis-in-august-back-to-the-inflation-target-set-by-the-bank-of-canada-statistics-canada-said-tuesday-credit-zou-zhengxinhuaalamy-live-news-image622329714.htmlRM2Y4DFW6–Toronto, Canada. 17th Sep, 2024. Customers shop for groceries at a market in Toronto, Canada, on Sept. 17, 2024. Canada's Consumer Price Index (CPI) rose 2 percent on a year-over-year basis in August, back to the inflation target set by the Bank of Canada, Statistics Canada said Tuesday. Credit: Zou Zheng/Xinhua/Alamy Live News

One person is answering question about inflation target. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/one-person-is-answering-question-about-inflation-target-image382667549.html

One person is answering question about inflation target. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/one-person-is-answering-question-about-inflation-target-image382667549.htmlRF2D6G0A5–One person is answering question about inflation target.

210709 -- FRANKFURT, July 9, 2021 -- European Central Bank ECB President Christine Lagarde speaks during a press conference on the results of the ECB strategy review held at the ECB headquarters in Frankfurt, Germany, on July 8, 2021. The European Central Bank said on Thursday that it has approved a new monetary policy strategy that adopts symmetric 2 percent inflation target over the medium term.FOR EDITORIAL USE ONLY. NOT FOR SALE FOR MARKETING OR ADVERTISING CAMPAIGNS. European Central Bank/Handout via Xinhua GERMANY-FRANKFURT-ECB-STRATEGY REVIEW LuxYang PUBLICATIONxNOTxINxCHN Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/210709-frankfurt-july-9-2021-european-central-bank-ecb-president-christine-lagarde-speaks-during-a-press-conference-on-the-results-of-the-ecb-strategy-review-held-at-the-ecb-headquarters-in-frankfurt-germany-on-july-8-2021-the-european-central-bank-said-on-thursday-that-it-has-approved-a-new-monetary-policy-strategy-that-adopts-symmetric-2-percent-inflation-target-over-the-medium-termfor-editorial-use-only-not-for-sale-for-marketing-or-advertising-campaigns-european-central-bankhandout-via-xinhua-germany-frankfurt-ecb-strategy-review-luxyang-publicationxnotxinxchn-image565088930.html

210709 -- FRANKFURT, July 9, 2021 -- European Central Bank ECB President Christine Lagarde speaks during a press conference on the results of the ECB strategy review held at the ECB headquarters in Frankfurt, Germany, on July 8, 2021. The European Central Bank said on Thursday that it has approved a new monetary policy strategy that adopts symmetric 2 percent inflation target over the medium term.FOR EDITORIAL USE ONLY. NOT FOR SALE FOR MARKETING OR ADVERTISING CAMPAIGNS. European Central Bank/Handout via Xinhua GERMANY-FRANKFURT-ECB-STRATEGY REVIEW LuxYang PUBLICATIONxNOTxINxCHN Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/210709-frankfurt-july-9-2021-european-central-bank-ecb-president-christine-lagarde-speaks-during-a-press-conference-on-the-results-of-the-ecb-strategy-review-held-at-the-ecb-headquarters-in-frankfurt-germany-on-july-8-2021-the-european-central-bank-said-on-thursday-that-it-has-approved-a-new-monetary-policy-strategy-that-adopts-symmetric-2-percent-inflation-target-over-the-medium-termfor-editorial-use-only-not-for-sale-for-marketing-or-advertising-campaigns-european-central-bankhandout-via-xinhua-germany-frankfurt-ecb-strategy-review-luxyang-publicationxnotxinxchn-image565088930.htmlRM2RRA0KE–210709 -- FRANKFURT, July 9, 2021 -- European Central Bank ECB President Christine Lagarde speaks during a press conference on the results of the ECB strategy review held at the ECB headquarters in Frankfurt, Germany, on July 8, 2021. The European Central Bank said on Thursday that it has approved a new monetary policy strategy that adopts symmetric 2 percent inflation target over the medium term.FOR EDITORIAL USE ONLY. NOT FOR SALE FOR MARKETING OR ADVERTISING CAMPAIGNS. European Central Bank/Handout via Xinhua GERMANY-FRANKFURT-ECB-STRATEGY REVIEW LuxYang PUBLICATIONxNOTxINxCHN

Haruhiko Kuroda, Governor of the Bank of Japan (BOJ) speaks during a press conference at the Foreign Correspondents' Club of Japan on March 20, 2015, Tokyo, Japan. Kuroda spoke about the challenges facing Japan's economy and Bank's policy measures to protect the economy. He also discussed inflation expectations that help to prevent the economy from falling into deflation. The Governor said on Thursday in a parliamentary address that BOJ bond purchases were aimed at hitting the 2 percent inflation target, and not at bankrolling public debt. Credit: Rodrigo Reyes Marin/AFLO/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-haruhiko-kuroda-governor-of-the-bank-of-japan-boj-speaks-during-a-79944141.html

Haruhiko Kuroda, Governor of the Bank of Japan (BOJ) speaks during a press conference at the Foreign Correspondents' Club of Japan on March 20, 2015, Tokyo, Japan. Kuroda spoke about the challenges facing Japan's economy and Bank's policy measures to protect the economy. He also discussed inflation expectations that help to prevent the economy from falling into deflation. The Governor said on Thursday in a parliamentary address that BOJ bond purchases were aimed at hitting the 2 percent inflation target, and not at bankrolling public debt. Credit: Rodrigo Reyes Marin/AFLO/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-haruhiko-kuroda-governor-of-the-bank-of-japan-boj-speaks-during-a-79944141.htmlRMEJ1NFW–Haruhiko Kuroda, Governor of the Bank of Japan (BOJ) speaks during a press conference at the Foreign Correspondents' Club of Japan on March 20, 2015, Tokyo, Japan. Kuroda spoke about the challenges facing Japan's economy and Bank's policy measures to protect the economy. He also discussed inflation expectations that help to prevent the economy from falling into deflation. The Governor said on Thursday in a parliamentary address that BOJ bond purchases were aimed at hitting the 2 percent inflation target, and not at bankrolling public debt. Credit: Rodrigo Reyes Marin/AFLO/Alamy Live News

London, UK. 30th Aug, 2023. The Bank of England in the City of London. The Bank's chief economist, Huw Pill has indicated that further interest rate rises may be used to reach their takget inflation rate of 2%. Inflation in the UK current'y stands at 6.8%. Credit: Anna Watson/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-30th-aug-2023-the-bank-of-england-in-the-city-of-london-the-banks-chief-economist-huw-pill-has-indicated-that-further-interest-rate-rises-may-be-used-to-reach-their-takget-inflation-rate-of-2-inflation-in-the-uk-currenty-stands-at-68-credit-anna-watsonalamy-live-news-image563699125.html

London, UK. 30th Aug, 2023. The Bank of England in the City of London. The Bank's chief economist, Huw Pill has indicated that further interest rate rises may be used to reach their takget inflation rate of 2%. Inflation in the UK current'y stands at 6.8%. Credit: Anna Watson/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-30th-aug-2023-the-bank-of-england-in-the-city-of-london-the-banks-chief-economist-huw-pill-has-indicated-that-further-interest-rate-rises-may-be-used-to-reach-their-takget-inflation-rate-of-2-inflation-in-the-uk-currenty-stands-at-68-credit-anna-watsonalamy-live-news-image563699125.htmlRM2RN2KYH–London, UK. 30th Aug, 2023. The Bank of England in the City of London. The Bank's chief economist, Huw Pill has indicated that further interest rate rises may be used to reach their takget inflation rate of 2%. Inflation in the UK current'y stands at 6.8%. Credit: Anna Watson/Alamy Live News

London, UK. 26th Jan, 2022. Protesters target Downing Street as Boris Johnson faces further demands to resign during Prime Ministers Questions due to ‘Partygate' and the highest rate of inflation for 30 years. 26th January 2022, Whitehall, London, England, UK Credit: Jeff Gilbert/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-26th-jan-2022-protesters-target-downing-street-as-boris-johnson-faces-further-demands-to-resign-during-prime-ministers-questions-due-to-partygate-and-the-highest-rate-of-inflation-for-30-years-26th-january-2022-whitehall-london-england-uk-credit-jeff-gilbertalamy-live-news-image458582536.html

London, UK. 26th Jan, 2022. Protesters target Downing Street as Boris Johnson faces further demands to resign during Prime Ministers Questions due to ‘Partygate' and the highest rate of inflation for 30 years. 26th January 2022, Whitehall, London, England, UK Credit: Jeff Gilbert/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-26th-jan-2022-protesters-target-downing-street-as-boris-johnson-faces-further-demands-to-resign-during-prime-ministers-questions-due-to-partygate-and-the-highest-rate-of-inflation-for-30-years-26th-january-2022-whitehall-london-england-uk-credit-jeff-gilbertalamy-live-news-image458582536.htmlRM2HJ26KM–London, UK. 26th Jan, 2022. Protesters target Downing Street as Boris Johnson faces further demands to resign during Prime Ministers Questions due to ‘Partygate' and the highest rate of inflation for 30 years. 26th January 2022, Whitehall, London, England, UK Credit: Jeff Gilbert/Alamy Live News

Shopping in a Whole Foods Market supermarket in New York on Wednesday, June 29, 2022. The Federal Reserve announced that it will continue to raise interest rates until it sees proof that inflation slows down to their target level, 2%. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-in-a-whole-foods-market-supermarket-in-new-york-on-wednesday-june-29-2022-the-federal-reserve-announced-that-it-will-continue-to-raise-interest-rates-until-it-sees-proof-that-inflation-slows-down-to-their-target-level-2-richard-b-levine-image474607928.html

Shopping in a Whole Foods Market supermarket in New York on Wednesday, June 29, 2022. The Federal Reserve announced that it will continue to raise interest rates until it sees proof that inflation slows down to their target level, 2%. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-in-a-whole-foods-market-supermarket-in-new-york-on-wednesday-june-29-2022-the-federal-reserve-announced-that-it-will-continue-to-raise-interest-rates-until-it-sees-proof-that-inflation-slows-down-to-their-target-level-2-richard-b-levine-image474607928.htmlRM2JG4774–Shopping in a Whole Foods Market supermarket in New York on Wednesday, June 29, 2022. The Federal Reserve announced that it will continue to raise interest rates until it sees proof that inflation slows down to their target level, 2%. (© Richard B. Levine)

Shopping in a Whole Foods Market supermarket in New York on Wednesday, August 30, 2023. The Personal Consumption Expenditures index, a gauge used to judge inflation, is reported to have climbed 3.3 percent, above the FedÕs 2 percent target. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-in-a-whole-foods-market-supermarket-in-new-york-on-wednesday-august-30-2023-the-personal-consumption-expenditures-index-a-gauge-used-to-judge-inflation-is-reported-to-have-climbed-33-percent-above-the-feds-2-percent-target-richard-b-levine-image565274126.html

Shopping in a Whole Foods Market supermarket in New York on Wednesday, August 30, 2023. The Personal Consumption Expenditures index, a gauge used to judge inflation, is reported to have climbed 3.3 percent, above the FedÕs 2 percent target. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-in-a-whole-foods-market-supermarket-in-new-york-on-wednesday-august-30-2023-the-personal-consumption-expenditures-index-a-gauge-used-to-judge-inflation-is-reported-to-have-climbed-33-percent-above-the-feds-2-percent-target-richard-b-levine-image565274126.htmlRM2RRJCWJ–Shopping in a Whole Foods Market supermarket in New York on Wednesday, August 30, 2023. The Personal Consumption Expenditures index, a gauge used to judge inflation, is reported to have climbed 3.3 percent, above the FedÕs 2 percent target. (© Richard B. Levine)

London, UK. 7 November 2024 A view of the Bank of England in Threadneedle street this morning. The Monetary committee of the Bank of England has decided to lower interest rates from 5- 4.75 percent after meeting the inflation target.Credit.Amer Ghazzal/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-7-november-2024-a-view-of-the-bank-of-england-in-threadneedle-street-this-morning-the-monetary-committee-of-the-bank-of-england-has-decided-to-lower-interest-rates-from-5-475-percent-after-meeting-the-inflation-targetcreditamer-ghazzalalamy-live-news-image629722982.html

London, UK. 7 November 2024 A view of the Bank of England in Threadneedle street this morning. The Monetary committee of the Bank of England has decided to lower interest rates from 5- 4.75 percent after meeting the inflation target.Credit.Amer Ghazzal/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-7-november-2024-a-view-of-the-bank-of-england-in-threadneedle-street-this-morning-the-monetary-committee-of-the-bank-of-england-has-decided-to-lower-interest-rates-from-5-475-percent-after-meeting-the-inflation-targetcreditamer-ghazzalalamy-live-news-image629722982.htmlRM2YGEA2E–London, UK. 7 November 2024 A view of the Bank of England in Threadneedle street this morning. The Monetary committee of the Bank of England has decided to lower interest rates from 5- 4.75 percent after meeting the inflation target.Credit.Amer Ghazzal/Alamy Live News

'Brexit import charges 'will add to food price inflation' Guardian newspaper Business headline cost of living article 27 June 2023 London England UK Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/brexit-import-charges-will-add-to-food-price-inflation-guardian-newspaper-business-headline-cost-of-living-article-27-june-2023-london-england-uk-image558417368.html

'Brexit import charges 'will add to food price inflation' Guardian newspaper Business headline cost of living article 27 June 2023 London England UK Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/brexit-import-charges-will-add-to-food-price-inflation-guardian-newspaper-business-headline-cost-of-living-article-27-june-2023-london-england-uk-image558417368.htmlRM2RCE31C–'Brexit import charges 'will add to food price inflation' Guardian newspaper Business headline cost of living article 27 June 2023 London England UK

Closeup photo of coin with 500 rupee note,economic growth,success pillars,salary growth,saving and investing ,financial boost,inflation Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/closeup-photo-of-coin-with-500-rupee-noteeconomic-growthsuccess-pillarssalary-growthsaving-and-investing-financial-boostinflation-image461158055.html

Closeup photo of coin with 500 rupee note,economic growth,success pillars,salary growth,saving and investing ,financial boost,inflation Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/closeup-photo-of-coin-with-500-rupee-noteeconomic-growthsuccess-pillarssalary-growthsaving-and-investing-financial-boostinflation-image461158055.htmlRF2HP7FPF–Closeup photo of coin with 500 rupee note,economic growth,success pillars,salary growth,saving and investing ,financial boost,inflation

A vegetable seller in Kolkata, India, 10 September, 2020. India's retail inflation likely stayed above Reserve Bank Of India's medium-term target range in August for the fifth month as the supply disruptions kept food and fuel prices high according to an Indian media report. (Photo by Indranil Aditya/NurPhoto) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/a-vegetable-seller-in-kolkata-india-10-september-2020-indias-retail-inflation-likely-stayed-above-reserve-bank-of-indias-medium-term-target-range-in-august-for-the-fifth-month-as-the-supply-disruptions-kept-food-and-fuel-prices-high-according-to-an-indian-media-report-photo-by-indranil-adityanurphoto-image489257621.html

A vegetable seller in Kolkata, India, 10 September, 2020. India's retail inflation likely stayed above Reserve Bank Of India's medium-term target range in August for the fifth month as the supply disruptions kept food and fuel prices high according to an Indian media report. (Photo by Indranil Aditya/NurPhoto) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/a-vegetable-seller-in-kolkata-india-10-september-2020-indias-retail-inflation-likely-stayed-above-reserve-bank-of-indias-medium-term-target-range-in-august-for-the-fifth-month-as-the-supply-disruptions-kept-food-and-fuel-prices-high-according-to-an-indian-media-report-photo-by-indranil-adityanurphoto-image489257621.htmlRM2KBYH2D–A vegetable seller in Kolkata, India, 10 September, 2020. India's retail inflation likely stayed above Reserve Bank Of India's medium-term target range in August for the fifth month as the supply disruptions kept food and fuel prices high according to an Indian media report. (Photo by Indranil Aditya/NurPhoto)

Recession target concept Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/recession-target-concept-image343623132.html

Recession target concept Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/recession-target-concept-image343623132.htmlRM2AY1APM–Recession target concept

Writing displaying text Finance Control. Business concept procedures that are implemented to manage finances Presenting Message Hitting Target Concept, Abstract Announcing Goal Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/writing-displaying-text-finance-control-business-concept-procedures-that-are-implemented-to-manage-finances-presenting-message-hitting-target-concept-abstract-announcing-goal-image483451244.html

Writing displaying text Finance Control. Business concept procedures that are implemented to manage finances Presenting Message Hitting Target Concept, Abstract Announcing Goal Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/writing-displaying-text-finance-control-business-concept-procedures-that-are-implemented-to-manage-finances-presenting-message-hitting-target-concept-abstract-announcing-goal-image483451244.htmlRF2K2F2YT–Writing displaying text Finance Control. Business concept procedures that are implemented to manage finances Presenting Message Hitting Target Concept, Abstract Announcing Goal

Business Grant Management. Future Target And Health Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/business-grant-management-future-target-and-health-image456781814.html

Business Grant Management. Future Target And Health Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/business-grant-management-future-target-and-health-image456781814.htmlRF2HF45T6–Business Grant Management. Future Target And Health

London, UK. 2 August 2023. The exterior of the Bank of England. In an attempt to curb inflation the monetary policy committee (MPC) of the Bank of England is expected to announce an increase in the base rate from 5.00% to 5.25%, though some speculate a rise to 5.5%. It would be the 14th consecutive increase, as the MPC tries to bring inflation down towards its 2 per cent target. A rise in the interest rate will make borrowing more expensive and deter spending. Credit: Stephen Chung / Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-2-august-2023-the-exterior-of-the-bank-of-england-in-an-attempt-to-curb-inflation-the-monetary-policy-committee-mpc-of-the-bank-of-england-is-expected-to-announce-an-increase-in-the-base-rate-from-500-to-525-though-some-speculate-a-rise-to-55-it-would-be-the-14th-consecutive-increase-as-the-mpc-tries-to-bring-inflation-down-towards-its-2-per-cent-target-a-rise-in-the-interest-rate-will-make-borrowing-more-expensive-and-deter-spending-credit-stephen-chung-alamy-live-news-image560200214.html

London, UK. 2 August 2023. The exterior of the Bank of England. In an attempt to curb inflation the monetary policy committee (MPC) of the Bank of England is expected to announce an increase in the base rate from 5.00% to 5.25%, though some speculate a rise to 5.5%. It would be the 14th consecutive increase, as the MPC tries to bring inflation down towards its 2 per cent target. A rise in the interest rate will make borrowing more expensive and deter spending. Credit: Stephen Chung / Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-2-august-2023-the-exterior-of-the-bank-of-england-in-an-attempt-to-curb-inflation-the-monetary-policy-committee-mpc-of-the-bank-of-england-is-expected-to-announce-an-increase-in-the-base-rate-from-500-to-525-though-some-speculate-a-rise-to-55-it-would-be-the-14th-consecutive-increase-as-the-mpc-tries-to-bring-inflation-down-towards-its-2-per-cent-target-a-rise-in-the-interest-rate-will-make-borrowing-more-expensive-and-deter-spending-credit-stephen-chung-alamy-live-news-image560200214.htmlRM2RFB92E–London, UK. 2 August 2023. The exterior of the Bank of England. In an attempt to curb inflation the monetary policy committee (MPC) of the Bank of England is expected to announce an increase in the base rate from 5.00% to 5.25%, though some speculate a rise to 5.5%. It would be the 14th consecutive increase, as the MPC tries to bring inflation down towards its 2 per cent target. A rise in the interest rate will make borrowing more expensive and deter spending. Credit: Stephen Chung / Alamy Live News

Federal Reserve Chairman Powell stated at a press conference on the same day that the current economic situation in the United States is good, and the Federal Reserve will adjust its policies based on future economic and inflation data. Washington, United States.7th November 2024. The Federal Reserve announced a 25 basis point reduction in the target range for the federal funds rate to between 4.50% and 4.75%, in line with market expectations. Washington, D.C., November 7, 2024. This is the second time since September that the Federal Reserve has cut interest rates. Credit: Sha Hanting/China N Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/federal-reserve-chairman-powell-stated-at-a-press-conference-on-the-same-day-that-the-current-economic-situation-in-the-united-states-is-good-and-the-federal-reserve-will-adjust-its-policies-based-on-future-economic-and-inflation-data-washington-united-states7th-november-2024-the-federal-reserve-announced-a-25-basis-point-reduction-in-the-target-range-for-the-federal-funds-rate-to-between-450-and-475-in-line-with-market-expectations-washington-dc-november-7-2024-this-is-the-second-time-since-september-that-the-federal-reserve-has-cut-interest-rates-credit-sha-hantingchina-n-image629858849.html

Federal Reserve Chairman Powell stated at a press conference on the same day that the current economic situation in the United States is good, and the Federal Reserve will adjust its policies based on future economic and inflation data. Washington, United States.7th November 2024. The Federal Reserve announced a 25 basis point reduction in the target range for the federal funds rate to between 4.50% and 4.75%, in line with market expectations. Washington, D.C., November 7, 2024. This is the second time since September that the Federal Reserve has cut interest rates. Credit: Sha Hanting/China N Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/federal-reserve-chairman-powell-stated-at-a-press-conference-on-the-same-day-that-the-current-economic-situation-in-the-united-states-is-good-and-the-federal-reserve-will-adjust-its-policies-based-on-future-economic-and-inflation-data-washington-united-states7th-november-2024-the-federal-reserve-announced-a-25-basis-point-reduction-in-the-target-range-for-the-federal-funds-rate-to-between-450-and-475-in-line-with-market-expectations-washington-dc-november-7-2024-this-is-the-second-time-since-september-that-the-federal-reserve-has-cut-interest-rates-credit-sha-hantingchina-n-image629858849.htmlRM2YGMFAW–Federal Reserve Chairman Powell stated at a press conference on the same day that the current economic situation in the United States is good, and the Federal Reserve will adjust its policies based on future economic and inflation data. Washington, United States.7th November 2024. The Federal Reserve announced a 25 basis point reduction in the target range for the federal funds rate to between 4.50% and 4.75%, in line with market expectations. Washington, D.C., November 7, 2024. This is the second time since September that the Federal Reserve has cut interest rates. Credit: Sha Hanting/China N

Bank of England. London, UK. 1st Nov, 2017. A general view of the outside the Bank of England (BOE) in the city. The Monetary Policy Committee (MPC) may raise interest rates on Thursday 2 November 2017 for the first time in more than a decade from 0.25% to 0.5%. The Bank's Monetary Policy Committee sets interest rates to meet the Government's 2% inflation target. According to the ratings agency Moody's the property prices would not be greatly affected as the market remains resilient. Credit: Dinendra Haria/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-image-bank-of-england-london-uk-1st-nov-2017-a-general-view-of-the-outside-164681599.html

Bank of England. London, UK. 1st Nov, 2017. A general view of the outside the Bank of England (BOE) in the city. The Monetary Policy Committee (MPC) may raise interest rates on Thursday 2 November 2017 for the first time in more than a decade from 0.25% to 0.5%. The Bank's Monetary Policy Committee sets interest rates to meet the Government's 2% inflation target. According to the ratings agency Moody's the property prices would not be greatly affected as the market remains resilient. Credit: Dinendra Haria/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-image-bank-of-england-london-uk-1st-nov-2017-a-general-view-of-the-outside-164681599.htmlRMKFWW1K–Bank of England. London, UK. 1st Nov, 2017. A general view of the outside the Bank of England (BOE) in the city. The Monetary Policy Committee (MPC) may raise interest rates on Thursday 2 November 2017 for the first time in more than a decade from 0.25% to 0.5%. The Bank's Monetary Policy Committee sets interest rates to meet the Government's 2% inflation target. According to the ratings agency Moody's the property prices would not be greatly affected as the market remains resilient. Credit: Dinendra Haria/Alamy Live News

PICTURE POSED BY A MODEL File photo dated 08/01/22 of person holding an energy bill. UK inflation is expected to swing back above the Bank of England's target due to higher energy prices. The Office for National Statistics (ONS) will unveil the latest monthly Consumer Prices Index (CPI) reading on Wednesday morning. The data is expected to show a significant rebound in inflation in October after it dropped to a three-year-low of 1.7% in the previous month. Issue date: Wednesday November 20, 2024. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/picture-posed-by-a-model-file-photo-dated-080122-of-person-holding-an-energy-bill-uk-inflation-is-expected-to-swing-back-above-the-bank-of-englands-target-due-to-higher-energy-prices-the-office-for-national-statistics-ons-will-unveil-the-latest-monthly-consumer-prices-index-cpi-reading-on-wednesday-morning-the-data-is-expected-to-show-a-significant-rebound-in-inflation-in-october-after-it-dropped-to-a-three-year-low-of-17-in-the-previous-month-issue-date-wednesday-november-20-2024-image631869017.html

PICTURE POSED BY A MODEL File photo dated 08/01/22 of person holding an energy bill. UK inflation is expected to swing back above the Bank of England's target due to higher energy prices. The Office for National Statistics (ONS) will unveil the latest monthly Consumer Prices Index (CPI) reading on Wednesday morning. The data is expected to show a significant rebound in inflation in October after it dropped to a three-year-low of 1.7% in the previous month. Issue date: Wednesday November 20, 2024. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/picture-posed-by-a-model-file-photo-dated-080122-of-person-holding-an-energy-bill-uk-inflation-is-expected-to-swing-back-above-the-bank-of-englands-target-due-to-higher-energy-prices-the-office-for-national-statistics-ons-will-unveil-the-latest-monthly-consumer-prices-index-cpi-reading-on-wednesday-morning-the-data-is-expected-to-show-a-significant-rebound-in-inflation-in-october-after-it-dropped-to-a-three-year-low-of-17-in-the-previous-month-issue-date-wednesday-november-20-2024-image631869017.htmlRM2YM03AH–PICTURE POSED BY A MODEL File photo dated 08/01/22 of person holding an energy bill. UK inflation is expected to swing back above the Bank of England's target due to higher energy prices. The Office for National Statistics (ONS) will unveil the latest monthly Consumer Prices Index (CPI) reading on Wednesday morning. The data is expected to show a significant rebound in inflation in October after it dropped to a three-year-low of 1.7% in the previous month. Issue date: Wednesday November 20, 2024.

Toronto, Canada. 17th Sep, 2024. Customers shop at a market in Toronto, Canada, on Sept. 17, 2024. Canada's Consumer Price Index (CPI) rose 2 percent on a year-over-year basis in August, back to the inflation target set by the Bank of Canada, Statistics Canada said Tuesday. Credit: Zou Zheng/Xinhua/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/toronto-canada-17th-sep-2024-customers-shop-at-a-market-in-toronto-canada-on-sept-17-2024-canadas-consumer-price-index-cpi-rose-2-percent-on-a-year-over-year-basis-in-august-back-to-the-inflation-target-set-by-the-bank-of-canada-statistics-canada-said-tuesday-credit-zou-zhengxinhuaalamy-live-news-image622329720.html

Toronto, Canada. 17th Sep, 2024. Customers shop at a market in Toronto, Canada, on Sept. 17, 2024. Canada's Consumer Price Index (CPI) rose 2 percent on a year-over-year basis in August, back to the inflation target set by the Bank of Canada, Statistics Canada said Tuesday. Credit: Zou Zheng/Xinhua/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/toronto-canada-17th-sep-2024-customers-shop-at-a-market-in-toronto-canada-on-sept-17-2024-canadas-consumer-price-index-cpi-rose-2-percent-on-a-year-over-year-basis-in-august-back-to-the-inflation-target-set-by-the-bank-of-canada-statistics-canada-said-tuesday-credit-zou-zhengxinhuaalamy-live-news-image622329720.htmlRM2Y4DFWC–Toronto, Canada. 17th Sep, 2024. Customers shop at a market in Toronto, Canada, on Sept. 17, 2024. Canada's Consumer Price Index (CPI) rose 2 percent on a year-over-year basis in August, back to the inflation target set by the Bank of Canada, Statistics Canada said Tuesday. Credit: Zou Zheng/Xinhua/Alamy Live News

RF2PFY2K2–Straight arrow rising up to the big target icon over wooden cube blocks graph steps on blue background, vertical style. Investment, income, inflation,

210709 -- FRANKFURT, July 9, 2021 -- European Central Bank ECB President Christine Lagarde C speaks during a press conference on the results of the ECB strategy review held at the ECB headquarters in Frankfurt, Germany, on July 8, 2021. The European Central Bank said on Thursday that it has approved a new monetary policy strategy that adopts symmetric 2 percent inflation target over the medium term.FOR EDITORIAL USE ONLY. NOT FOR SALE FOR MARKETING OR ADVERTISING CAMPAIGNS. European Central Bank/Handout via Xinhua GERMANY-FRANKFURT-ECB-STRATEGY REVIEW LuxYang PUBLICATIONxNOTxINxCHN Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/210709-frankfurt-july-9-2021-european-central-bank-ecb-president-christine-lagarde-c-speaks-during-a-press-conference-on-the-results-of-the-ecb-strategy-review-held-at-the-ecb-headquarters-in-frankfurt-germany-on-july-8-2021-the-european-central-bank-said-on-thursday-that-it-has-approved-a-new-monetary-policy-strategy-that-adopts-symmetric-2-percent-inflation-target-over-the-medium-termfor-editorial-use-only-not-for-sale-for-marketing-or-advertising-campaigns-european-central-bankhandout-via-xinhua-germany-frankfurt-ecb-strategy-review-luxyang-publicationxnotxinxchn-image565088921.html

210709 -- FRANKFURT, July 9, 2021 -- European Central Bank ECB President Christine Lagarde C speaks during a press conference on the results of the ECB strategy review held at the ECB headquarters in Frankfurt, Germany, on July 8, 2021. The European Central Bank said on Thursday that it has approved a new monetary policy strategy that adopts symmetric 2 percent inflation target over the medium term.FOR EDITORIAL USE ONLY. NOT FOR SALE FOR MARKETING OR ADVERTISING CAMPAIGNS. European Central Bank/Handout via Xinhua GERMANY-FRANKFURT-ECB-STRATEGY REVIEW LuxYang PUBLICATIONxNOTxINxCHN Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/210709-frankfurt-july-9-2021-european-central-bank-ecb-president-christine-lagarde-c-speaks-during-a-press-conference-on-the-results-of-the-ecb-strategy-review-held-at-the-ecb-headquarters-in-frankfurt-germany-on-july-8-2021-the-european-central-bank-said-on-thursday-that-it-has-approved-a-new-monetary-policy-strategy-that-adopts-symmetric-2-percent-inflation-target-over-the-medium-termfor-editorial-use-only-not-for-sale-for-marketing-or-advertising-campaigns-european-central-bankhandout-via-xinhua-germany-frankfurt-ecb-strategy-review-luxyang-publicationxnotxinxchn-image565088921.htmlRM2RRA0K5–210709 -- FRANKFURT, July 9, 2021 -- European Central Bank ECB President Christine Lagarde C speaks during a press conference on the results of the ECB strategy review held at the ECB headquarters in Frankfurt, Germany, on July 8, 2021. The European Central Bank said on Thursday that it has approved a new monetary policy strategy that adopts symmetric 2 percent inflation target over the medium term.FOR EDITORIAL USE ONLY. NOT FOR SALE FOR MARKETING OR ADVERTISING CAMPAIGNS. European Central Bank/Handout via Xinhua GERMANY-FRANKFURT-ECB-STRATEGY REVIEW LuxYang PUBLICATIONxNOTxINxCHN

Haruhiko Kuroda, Governor of the Bank of Japan (BOJ) speaks during a press conference at the Foreign Correspondents' Club of Japan on March 20, 2015, Tokyo, Japan. Kuroda spoke about the challenges facing Japan's economy and Bank's policy measures to protect the economy. He also discussed inflation expectations that help to prevent the economy from falling into deflation. The Governor said on Thursday in a parliamentary address that BOJ bond purchases were aimed at hitting the 2 percent inflation target, and not at bankrolling public debt. Credit: Rodrigo Reyes Marin/AFLO/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-haruhiko-kuroda-governor-of-the-bank-of-japan-boj-speaks-during-a-79944094.html

Haruhiko Kuroda, Governor of the Bank of Japan (BOJ) speaks during a press conference at the Foreign Correspondents' Club of Japan on March 20, 2015, Tokyo, Japan. Kuroda spoke about the challenges facing Japan's economy and Bank's policy measures to protect the economy. He also discussed inflation expectations that help to prevent the economy from falling into deflation. The Governor said on Thursday in a parliamentary address that BOJ bond purchases were aimed at hitting the 2 percent inflation target, and not at bankrolling public debt. Credit: Rodrigo Reyes Marin/AFLO/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-haruhiko-kuroda-governor-of-the-bank-of-japan-boj-speaks-during-a-79944094.htmlRMEJ1NE6–Haruhiko Kuroda, Governor of the Bank of Japan (BOJ) speaks during a press conference at the Foreign Correspondents' Club of Japan on March 20, 2015, Tokyo, Japan. Kuroda spoke about the challenges facing Japan's economy and Bank's policy measures to protect the economy. He also discussed inflation expectations that help to prevent the economy from falling into deflation. The Governor said on Thursday in a parliamentary address that BOJ bond purchases were aimed at hitting the 2 percent inflation target, and not at bankrolling public debt. Credit: Rodrigo Reyes Marin/AFLO/Alamy Live News

London, UK. 30th Aug, 2023. The Bank of England in the City of London. The Bank's chief economist, Huw Pill has indicated that further interest rate rises may be used to reach their takget inflation rate of 2%. Inflation in the UK current'y stands at 6.8%. Credit: Anna Watson/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-30th-aug-2023-the-bank-of-england-in-the-city-of-london-the-banks-chief-economist-huw-pill-has-indicated-that-further-interest-rate-rises-may-be-used-to-reach-their-takget-inflation-rate-of-2-inflation-in-the-uk-currenty-stands-at-68-credit-anna-watsonalamy-live-news-image563698993.html

London, UK. 30th Aug, 2023. The Bank of England in the City of London. The Bank's chief economist, Huw Pill has indicated that further interest rate rises may be used to reach their takget inflation rate of 2%. Inflation in the UK current'y stands at 6.8%. Credit: Anna Watson/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-30th-aug-2023-the-bank-of-england-in-the-city-of-london-the-banks-chief-economist-huw-pill-has-indicated-that-further-interest-rate-rises-may-be-used-to-reach-their-takget-inflation-rate-of-2-inflation-in-the-uk-currenty-stands-at-68-credit-anna-watsonalamy-live-news-image563698993.htmlRM2RN2KPW–London, UK. 30th Aug, 2023. The Bank of England in the City of London. The Bank's chief economist, Huw Pill has indicated that further interest rate rises may be used to reach their takget inflation rate of 2%. Inflation in the UK current'y stands at 6.8%. Credit: Anna Watson/Alamy Live News

Protesters target Downing Street as Boris Johnson faces further demands to resign due to ‘Partygate' and the highest rate of inflation in 30 years, UK Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/protesters-target-downing-street-as-boris-johnson-faces-further-demands-to-resign-due-to-partygate-and-the-highest-rate-of-inflation-in-30-years-uk-image459526302.html

Protesters target Downing Street as Boris Johnson faces further demands to resign due to ‘Partygate' and the highest rate of inflation in 30 years, UK Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/protesters-target-downing-street-as-boris-johnson-faces-further-demands-to-resign-due-to-partygate-and-the-highest-rate-of-inflation-in-30-years-uk-image459526302.htmlRM2HKH6DJ–Protesters target Downing Street as Boris Johnson faces further demands to resign due to ‘Partygate' and the highest rate of inflation in 30 years, UK

Shopping with her Target purchases in Herald Square in New York on Tuesday, October 11, 2022. (© Frances M. Roberts) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-with-her-target-purchases-in-herald-square-in-new-york-on-tuesday-october-11-2022-frances-m-roberts-image485867267.html

Shopping with her Target purchases in Herald Square in New York on Tuesday, October 11, 2022. (© Frances M. Roberts) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-with-her-target-purchases-in-herald-square-in-new-york-on-tuesday-october-11-2022-frances-m-roberts-image485867267.htmlRM2K6D4JB–Shopping with her Target purchases in Herald Square in New York on Tuesday, October 11, 2022. (© Frances M. Roberts)

Shopping in a Whole Foods Market supermarket in New York on Wednesday, August 30, 2023. The Personal Consumption Expenditures index, a gauge used to judge inflation, is reported to have climbed 3.3 percent, above the FedÕs 2 percent target. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-in-a-whole-foods-market-supermarket-in-new-york-on-wednesday-august-30-2023-the-personal-consumption-expenditures-index-a-gauge-used-to-judge-inflation-is-reported-to-have-climbed-33-percent-above-the-feds-2-percent-target-richard-b-levine-image565274090.html

Shopping in a Whole Foods Market supermarket in New York on Wednesday, August 30, 2023. The Personal Consumption Expenditures index, a gauge used to judge inflation, is reported to have climbed 3.3 percent, above the FedÕs 2 percent target. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/shopping-in-a-whole-foods-market-supermarket-in-new-york-on-wednesday-august-30-2023-the-personal-consumption-expenditures-index-a-gauge-used-to-judge-inflation-is-reported-to-have-climbed-33-percent-above-the-feds-2-percent-target-richard-b-levine-image565274090.htmlRM2RRJCTA–Shopping in a Whole Foods Market supermarket in New York on Wednesday, August 30, 2023. The Personal Consumption Expenditures index, a gauge used to judge inflation, is reported to have climbed 3.3 percent, above the FedÕs 2 percent target. (© Richard B. Levine)

London, UK. 7 November 2024 A view of the Bank of England in Threadneedle street this morning. The Monetary committee of the Bank of England is expected to lower interest rates from by from 5- 4.75 percent later after meeting the inflation target.Credit.Amer Ghazzal/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-7-november-2024-a-view-of-the-bank-of-england-in-threadneedle-street-this-morning-the-monetary-committee-of-the-bank-of-england-is-expected-to-lower-interest-rates-from-by-from-5-475-percent-later-after-meeting-the-inflation-targetcreditamer-ghazzalalamy-live-news-image629692462.html

London, UK. 7 November 2024 A view of the Bank of England in Threadneedle street this morning. The Monetary committee of the Bank of England is expected to lower interest rates from by from 5- 4.75 percent later after meeting the inflation target.Credit.Amer Ghazzal/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-7-november-2024-a-view-of-the-bank-of-england-in-threadneedle-street-this-morning-the-monetary-committee-of-the-bank-of-england-is-expected-to-lower-interest-rates-from-by-from-5-475-percent-later-after-meeting-the-inflation-targetcreditamer-ghazzalalamy-live-news-image629692462.htmlRM2YGCY4E–London, UK. 7 November 2024 A view of the Bank of England in Threadneedle street this morning. The Monetary committee of the Bank of England is expected to lower interest rates from by from 5- 4.75 percent later after meeting the inflation target.Credit.Amer Ghazzal/Alamy Live News

Business Grant Management Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/business-grant-management-image483253408.html

Business Grant Management Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/business-grant-management-image483253408.htmlRF2K262J8–Business Grant Management

Target. The picture shows a target, darts and a torn piece of paper with the inscription - INFLATION Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/target-the-picture-shows-a-target-darts-and-a-torn-piece-of-paper-with-the-inscription-inflation-image485818440.html

Target. The picture shows a target, darts and a torn piece of paper with the inscription - INFLATION Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/target-the-picture-shows-a-target-darts-and-a-torn-piece-of-paper-with-the-inscription-inflation-image485818440.htmlRF2K6AXAG–Target. The picture shows a target, darts and a torn piece of paper with the inscription - INFLATION

A vegetable seller in Kolkata, India, 10 September, 2020. India's retail inflation likely stayed above Reserve Bank Of India's medium-term target range in August for the fifth month as the supply disruptions kept food and fuel prices high according to an Indian media report. (Photo by Indranil Aditya/NurPhoto) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/a-vegetable-seller-in-kolkata-india-10-september-2020-indias-retail-inflation-likely-stayed-above-reserve-bank-of-indias-medium-term-target-range-in-august-for-the-fifth-month-as-the-supply-disruptions-kept-food-and-fuel-prices-high-according-to-an-indian-media-report-photo-by-indranil-adityanurphoto-image489257607.html

A vegetable seller in Kolkata, India, 10 September, 2020. India's retail inflation likely stayed above Reserve Bank Of India's medium-term target range in August for the fifth month as the supply disruptions kept food and fuel prices high according to an Indian media report. (Photo by Indranil Aditya/NurPhoto) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/a-vegetable-seller-in-kolkata-india-10-september-2020-indias-retail-inflation-likely-stayed-above-reserve-bank-of-indias-medium-term-target-range-in-august-for-the-fifth-month-as-the-supply-disruptions-kept-food-and-fuel-prices-high-according-to-an-indian-media-report-photo-by-indranil-adityanurphoto-image489257607.htmlRM2KBYH1Y–A vegetable seller in Kolkata, India, 10 September, 2020. India's retail inflation likely stayed above Reserve Bank Of India's medium-term target range in August for the fifth month as the supply disruptions kept food and fuel prices high according to an Indian media report. (Photo by Indranil Aditya/NurPhoto)

Concept of monetary inflation or interest rate. A target with a dart with the flag of the USA, banknotes of EURO and USA in one hundred dollars around Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/concept-of-monetary-inflation-or-interest-rate-a-target-with-a-dart-with-the-flag-of-the-usa-banknotes-of-euro-and-usa-in-one-hundred-dollars-around-image353359174.html

Concept of monetary inflation or interest rate. A target with a dart with the flag of the USA, banknotes of EURO and USA in one hundred dollars around Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/concept-of-monetary-inflation-or-interest-rate-a-target-with-a-dart-with-the-flag-of-the-usa-banknotes-of-euro-and-usa-in-one-hundred-dollars-around-image353359174.htmlRF2BETW6E–Concept of monetary inflation or interest rate. A target with a dart with the flag of the USA, banknotes of EURO and USA in one hundred dollars around

Inspiration showing sign Market Share. Business approach The portion of a market controlled by a particular company Arrow moving quickly towards aim target representing achieving goals. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/inspiration-showing-sign-market-share-business-approach-the-portion-of-a-market-controlled-by-a-particular-company-arrow-moving-quickly-towards-aim-target-representing-achieving-goals-image483545921.html

Inspiration showing sign Market Share. Business approach The portion of a market controlled by a particular company Arrow moving quickly towards aim target representing achieving goals. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/inspiration-showing-sign-market-share-business-approach-the-portion-of-a-market-controlled-by-a-particular-company-arrow-moving-quickly-towards-aim-target-representing-achieving-goals-image483545921.htmlRF2K2KBN5–Inspiration showing sign Market Share. Business approach The portion of a market controlled by a particular company Arrow moving quickly towards aim target representing achieving goals.

Money Inflation And Coins. Investor Saving Wealth Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/money-inflation-and-coins-investor-saving-wealth-image466890687.html

Money Inflation And Coins. Investor Saving Wealth Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/money-inflation-and-coins-investor-saving-wealth-image466890687.htmlRF2J3GKRB–Money Inflation And Coins. Investor Saving Wealth

London, UK. 2 August 2023. The exterior of the Bank of England. In an attempt to curb inflation the monetary policy committee (MPC) of the Bank of England is expected to announce an increase in the base rate from 5.00% to 5.25%, though some speculate a rise to 5.5%. It would be the 14th consecutive increase, as the MPC tries to bring inflation down towards its 2 per cent target. A rise in the interest rate will make borrowing more expensive and deter spending. Credit: Stephen Chung / Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/london-uk-2-august-2023-the-exterior-of-the-bank-of-england-in-an-attempt-to-curb-inflation-the-monetary-policy-committee-mpc-of-the-bank-of-england-is-expected-to-announce-an-increase-in-the-base-rate-from-500-to-525-though-some-speculate-a-rise-to-55-it-would-be-the-14th-consecutive-increase-as-the-mpc-tries-to-bring-inflation-down-towards-its-2-per-cent-target-a-rise-in-the-interest-rate-will-make-borrowing-more-expensive-and-deter-spending-credit-stephen-chung-alamy-live-news-image560200066.html