Quick filters:

Its biggest shareholder Stock Photos and Images

469 million deal which will make Italy's Exor, controlled by the Agnelli dynasty, its biggest shareholder. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-469-million-deal-which-will-make-italys-exor-controlled-by-the-agnelli-108330511.html

469 million deal which will make Italy's Exor, controlled by the Agnelli dynasty, its biggest shareholder. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-469-million-deal-which-will-make-italys-exor-controlled-by-the-agnelli-108330511.htmlRMG86TJR–469 million deal which will make Italy's Exor, controlled by the Agnelli dynasty, its biggest shareholder.

--File--View of the Capital Mansion, the headquarters of CITIC Group, in Beijing, China, 23 July 2010. Chinas Citic Group, the biggest shareholder i Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-view-of-the-capital-mansion-the-headquarters-of-citic-group-in-beijing-china-23-july-2010-chinas-citic-group-the-biggest-shareholder-i-image263874646.html

--File--View of the Capital Mansion, the headquarters of CITIC Group, in Beijing, China, 23 July 2010. Chinas Citic Group, the biggest shareholder i Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-view-of-the-capital-mansion-the-headquarters-of-citic-group-in-beijing-china-23-july-2010-chinas-citic-group-the-biggest-shareholder-i-image263874646.htmlRMW98EPE–--File--View of the Capital Mansion, the headquarters of CITIC Group, in Beijing, China, 23 July 2010. Chinas Citic Group, the biggest shareholder i

A branch of Bank of America in New York on Friday, June 30, 2017. Berkshire Hathaway is reported to be exercising its warrants to buy 700 million shares of Bank of America making it its biggest shareholder. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-branch-of-bank-of-america-in-new-york-on-friday-june-30-2017-berkshire-147725368.html

A branch of Bank of America in New York on Friday, June 30, 2017. Berkshire Hathaway is reported to be exercising its warrants to buy 700 million shares of Bank of America making it its biggest shareholder. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-branch-of-bank-of-america-in-new-york-on-friday-june-30-2017-berkshire-147725368.htmlRMJG9D60–A branch of Bank of America in New York on Friday, June 30, 2017. Berkshire Hathaway is reported to be exercising its warrants to buy 700 million shares of Bank of America making it its biggest shareholder. (© Richard B. Levine)

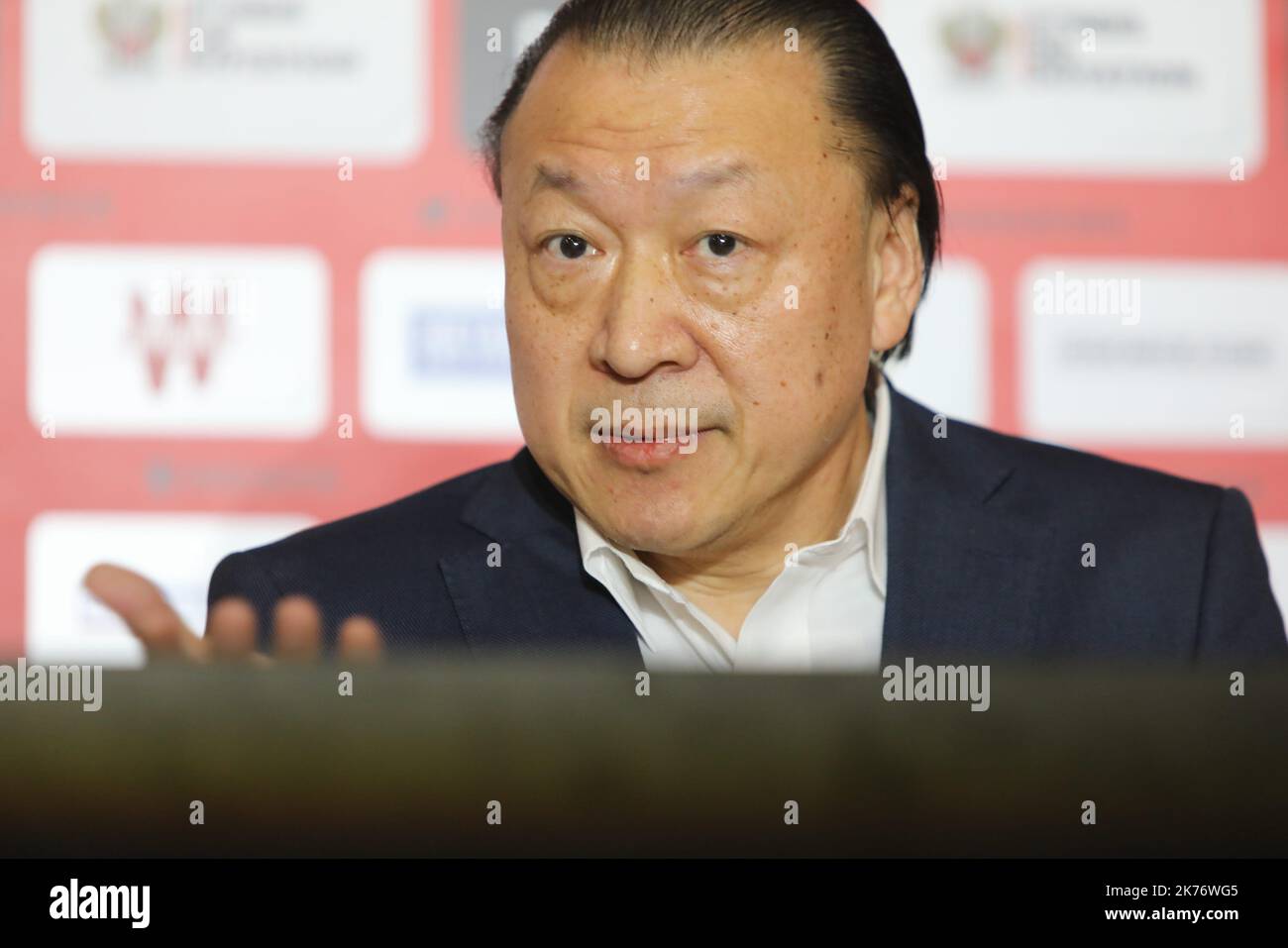

Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/chinese-investors-buy-french-soccer-club-ogc-nice-here-during-a-press-conference-chien-lee-chinese-american-entrepreneur-and-investor-and-the-founder-and-chairman-of-newcity-capital-a-private-investment-firm-and-now-chairman-and-biggest-shareholder-of-ogc-nice-football-club-image486344666.html

Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/chinese-investors-buy-french-soccer-club-ogc-nice-here-during-a-press-conference-chien-lee-chinese-american-entrepreneur-and-investor-and-the-founder-and-chairman-of-newcity-capital-a-private-investment-firm-and-now-chairman-and-biggest-shareholder-of-ogc-nice-football-club-image486344666.htmlRM2K76WGA–Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club.

Madrid, Madrid, Spain. 20th Mar, 2019. A 'Dia' supermarket seen in central Madrid.Shareholders gave their support to Russian businessman Mikhail Fridman, Spanish supermarket group DIA's biggest shareholder with a 29 percent stake, in the battle for control of the company. Fridman's Letter on fund, proposes raising 500 million euros in fresh capital, values DIA at just over 410 million euros. Credit: John Milner/SOPA Images/ZUMA Wire/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/madrid-madrid-spain-20th-mar-2019-a-dia-supermarket-seen-in-central-madridshareholders-gave-their-support-to-russian-businessman-mikhail-fridman-spanish-supermarket-group-dias-biggest-shareholder-with-a-29-percent-stake-in-the-battle-for-control-of-the-company-fridmans-letter-on-fund-proposes-raising-500-million-euros-in-fresh-capital-values-dia-at-just-over-410-million-euros-credit-john-milnersopa-imageszuma-wirealamy-live-news-image241360110.html

Madrid, Madrid, Spain. 20th Mar, 2019. A 'Dia' supermarket seen in central Madrid.Shareholders gave their support to Russian businessman Mikhail Fridman, Spanish supermarket group DIA's biggest shareholder with a 29 percent stake, in the battle for control of the company. Fridman's Letter on fund, proposes raising 500 million euros in fresh capital, values DIA at just over 410 million euros. Credit: John Milner/SOPA Images/ZUMA Wire/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/madrid-madrid-spain-20th-mar-2019-a-dia-supermarket-seen-in-central-madridshareholders-gave-their-support-to-russian-businessman-mikhail-fridman-spanish-supermarket-group-dias-biggest-shareholder-with-a-29-percent-stake-in-the-battle-for-control-of-the-company-fridmans-letter-on-fund-proposes-raising-500-million-euros-in-fresh-capital-values-dia-at-just-over-410-million-euros-credit-john-milnersopa-imageszuma-wirealamy-live-news-image241360110.htmlRMT0JW7X–Madrid, Madrid, Spain. 20th Mar, 2019. A 'Dia' supermarket seen in central Madrid.Shareholders gave their support to Russian businessman Mikhail Fridman, Spanish supermarket group DIA's biggest shareholder with a 29 percent stake, in the battle for control of the company. Fridman's Letter on fund, proposes raising 500 million euros in fresh capital, values DIA at just over 410 million euros. Credit: John Milner/SOPA Images/ZUMA Wire/Alamy Live News

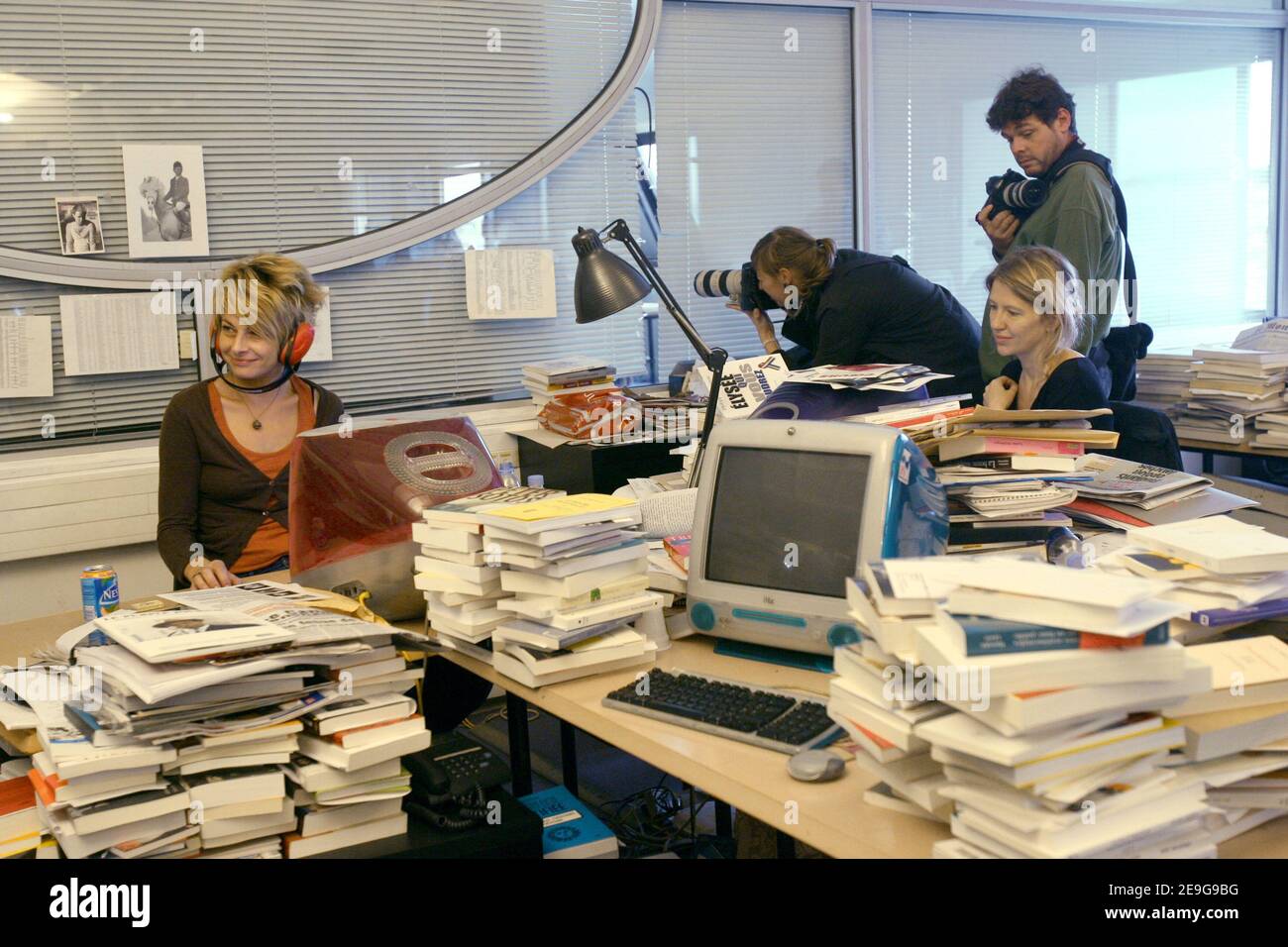

The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/the-unlikely-marriage-between-a-rothschild-heir-and-liberation-the-left-wing-tabloid-born-in-the-rubble-of-frances-1968-student-riots-is-already-on-the-rocks-edouard-de-rothschild-who-last-year-paid-euro-20-million-us26-million-to-become-the-newspapers-biggest-shareholder-is-to-present-a-last-chance-turnaround-plan-to-staff-representatives-and-other-board-members-in-paris-france-on-september-27-2006-photo-by-mehdi-taamallahabacapresscom-image401729047.html

The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/the-unlikely-marriage-between-a-rothschild-heir-and-liberation-the-left-wing-tabloid-born-in-the-rubble-of-frances-1968-student-riots-is-already-on-the-rocks-edouard-de-rothschild-who-last-year-paid-euro-20-million-us26-million-to-become-the-newspapers-biggest-shareholder-is-to-present-a-last-chance-turnaround-plan-to-staff-representatives-and-other-board-members-in-paris-france-on-september-27-2006-photo-by-mehdi-taamallahabacapresscom-image401729047.htmlRF2E9G9DY–The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM

Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/erich-sixt-chairman-and-biggest-single-shareholder-of-car-rental-company-image67895207.html

Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/erich-sixt-chairman-and-biggest-single-shareholder-of-car-rental-company-image67895207.htmlRMDXCW0R–Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa

A TUI shareholder skims through an Egypt travel catalogue at the TUI general meeting in Hanover, Germany, 09 February 2011. Europe's biggest travel group TUI reduced the season-common Q1 low due to increasing demand and decreasing costs and reports a loss of 46.4 million euro. Photo: Caroline Seidel Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-atuishareholder-skims-through-an-egypt-travel-catalogue-at-the-tuigeneral-58111392.html

A TUI shareholder skims through an Egypt travel catalogue at the TUI general meeting in Hanover, Germany, 09 February 2011. Europe's biggest travel group TUI reduced the season-common Q1 low due to increasing demand and decreasing costs and reports a loss of 46.4 million euro. Photo: Caroline Seidel Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-atuishareholder-skims-through-an-egypt-travel-catalogue-at-the-tuigeneral-58111392.htmlRMDAF5JT–A TUI shareholder skims through an Egypt travel catalogue at the TUI general meeting in Hanover, Germany, 09 February 2011. Europe's biggest travel group TUI reduced the season-common Q1 low due to increasing demand and decreasing costs and reports a loss of 46.4 million euro. Photo: Caroline Seidel

FILE PICS. 11th March, 2024. A Thames Water vehicle parked by the side of the road in Harefield in the London Borough of Hillingdon. Thames Water, the biggest water company in the UK with a dreadful record on sewage spills, will not be joining an industry wide £180m fund aimed at preventing sewage spills. It has been reported that Thames Water may run out of money by the end of April. Credit: Maureen McLean/Alamy Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-pics-11th-march-2024-a-thames-water-vehicle-parked-by-the-side-of-the-road-in-harefield-in-the-london-borough-of-hillingdon-thames-water-the-biggest-water-company-in-the-uk-with-a-dreadful-record-on-sewage-spills-will-not-be-joining-an-industry-wide-180m-fund-aimed-at-preventing-sewage-spills-it-has-been-reported-that-thames-water-may-run-out-of-money-by-the-end-of-april-credit-maureen-mcleanalamy-image599484988.html

FILE PICS. 11th March, 2024. A Thames Water vehicle parked by the side of the road in Harefield in the London Borough of Hillingdon. Thames Water, the biggest water company in the UK with a dreadful record on sewage spills, will not be joining an industry wide £180m fund aimed at preventing sewage spills. It has been reported that Thames Water may run out of money by the end of April. Credit: Maureen McLean/Alamy Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-pics-11th-march-2024-a-thames-water-vehicle-parked-by-the-side-of-the-road-in-harefield-in-the-london-borough-of-hillingdon-thames-water-the-biggest-water-company-in-the-uk-with-a-dreadful-record-on-sewage-spills-will-not-be-joining-an-industry-wide-180m-fund-aimed-at-preventing-sewage-spills-it-has-been-reported-that-thames-water-may-run-out-of-money-by-the-end-of-april-credit-maureen-mcleanalamy-image599484988.htmlRF2WR8W64–FILE PICS. 11th March, 2024. A Thames Water vehicle parked by the side of the road in Harefield in the London Borough of Hillingdon. Thames Water, the biggest water company in the UK with a dreadful record on sewage spills, will not be joining an industry wide £180m fund aimed at preventing sewage spills. It has been reported that Thames Water may run out of money by the end of April. Credit: Maureen McLean/Alamy

Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/enefit-and-elektrilevi-building-in-tallinn-enefit-is-the-biggest-energy-producer-and-one-of-the-biggest-producers-of-renewable-energy-in-the-baltics-image466732265.html

Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/enefit-and-elektrilevi-building-in-tallinn-enefit-is-the-biggest-energy-producer-and-one-of-the-biggest-producers-of-renewable-energy-in-the-baltics-image466732265.htmlRF2J39DND–Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics.

Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/twitter-app-displayed-on-the-smartphone-with-finger-twitter-one-of-the-biggest-social-network-website-social-media-app-social-network-elon-musk-image227646500.html

Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/twitter-app-displayed-on-the-smartphone-with-finger-twitter-one-of-the-biggest-social-network-website-social-media-app-social-network-elon-musk-image227646500.htmlRFR6A5C4–Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk

Emilio Botin, chairman of Spain's biggest bank Santander Central Hispano attends a shareholders meeting in Santander, northern Spain. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-emilio-botin-chairman-of-spains-biggest-bank-santander-central-hispano-13200305.html

Emilio Botin, chairman of Spain's biggest bank Santander Central Hispano attends a shareholders meeting in Santander, northern Spain. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-emilio-botin-chairman-of-spains-biggest-bank-santander-central-hispano-13200305.htmlRMACNN8J–Emilio Botin, chairman of Spain's biggest bank Santander Central Hispano attends a shareholders meeting in Santander, northern Spain.

Rem Vyakhirev former chair (b4 2000) of Russia's Gazprom natural gas monopoly, one of Russia's biggest cash cows and sponsor, national wealth jewel. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/rem-vyakhirev-former-chair-b4-2000-of-russias-gazprom-natural-gas-image6140763.html

Rem Vyakhirev former chair (b4 2000) of Russia's Gazprom natural gas monopoly, one of Russia's biggest cash cows and sponsor, national wealth jewel. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/rem-vyakhirev-former-chair-b4-2000-of-russias-gazprom-natural-gas-image6140763.htmlRMA3CWWC–Rem Vyakhirev former chair (b4 2000) of Russia's Gazprom natural gas monopoly, one of Russia's biggest cash cows and sponsor, national wealth jewel.

A woman reads a copy of The Economist magazine. Publishing group Pearson has agreed to sell its 50% stake in the Economist Group in a £469 million deal which will make Italy's Exor, controlled by the Agnelli dynasty, its biggest shareholder. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-woman-reads-a-copy-of-the-economist-magazine-publishing-group-pearson-108330507.html

A woman reads a copy of The Economist magazine. Publishing group Pearson has agreed to sell its 50% stake in the Economist Group in a £469 million deal which will make Italy's Exor, controlled by the Agnelli dynasty, its biggest shareholder. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-woman-reads-a-copy-of-the-economist-magazine-publishing-group-pearson-108330507.htmlRMG86TJK–A woman reads a copy of The Economist magazine. Publishing group Pearson has agreed to sell its 50% stake in the Economist Group in a £469 million deal which will make Italy's Exor, controlled by the Agnelli dynasty, its biggest shareholder.

A branch of Bank of America in New York on Friday, June 30, 2017. Berkshire Hathaway is reported to be exercising its warrants to buy 700 million shares of Bank of America making it its biggest shareholder. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-branch-of-bank-of-america-in-new-york-on-friday-june-30-2017-berkshire-147725362.html

A branch of Bank of America in New York on Friday, June 30, 2017. Berkshire Hathaway is reported to be exercising its warrants to buy 700 million shares of Bank of America making it its biggest shareholder. (© Richard B. Levine) Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-branch-of-bank-of-america-in-new-york-on-friday-june-30-2017-berkshire-147725362.htmlRMJG9D5P–A branch of Bank of America in New York on Friday, June 30, 2017. Berkshire Hathaway is reported to be exercising its warrants to buy 700 million shares of Bank of America making it its biggest shareholder. (© Richard B. Levine)

Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/chinese-investors-buy-french-soccer-club-ogc-nice-here-during-a-press-conference-chien-lee-chinese-american-entrepreneur-and-investor-and-the-founder-and-chairman-of-newcity-capital-a-private-investment-firm-and-now-chairman-and-biggest-shareholder-of-ogc-nice-football-club-image486344650.html

Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/chinese-investors-buy-french-soccer-club-ogc-nice-here-during-a-press-conference-chien-lee-chinese-american-entrepreneur-and-investor-and-the-founder-and-chairman-of-newcity-capital-a-private-investment-firm-and-now-chairman-and-biggest-shareholder-of-ogc-nice-football-club-image486344650.htmlRM2K76WFP–Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club.

Madrid, Madrid, Spain. 20th Mar, 2019. A 'Dia' supermarket seen in central Madrid.Shareholders gave their support to Russian businessman Mikhail Fridman, Spanish supermarket group DIA's biggest shareholder with a 29 percent stake, in the battle for control of the company. Fridman's Letter on fund, proposes raising 500 million euros in fresh capital, values DIA at just over 410 million euros. Credit: John Milner/SOPA Images/ZUMA Wire/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/madrid-madrid-spain-20th-mar-2019-a-dia-supermarket-seen-in-central-madridshareholders-gave-their-support-to-russian-businessman-mikhail-fridman-spanish-supermarket-group-dias-biggest-shareholder-with-a-29-percent-stake-in-the-battle-for-control-of-the-company-fridmans-letter-on-fund-proposes-raising-500-million-euros-in-fresh-capital-values-dia-at-just-over-410-million-euros-credit-john-milnersopa-imageszuma-wirealamy-live-news-image241360106.html

Madrid, Madrid, Spain. 20th Mar, 2019. A 'Dia' supermarket seen in central Madrid.Shareholders gave their support to Russian businessman Mikhail Fridman, Spanish supermarket group DIA's biggest shareholder with a 29 percent stake, in the battle for control of the company. Fridman's Letter on fund, proposes raising 500 million euros in fresh capital, values DIA at just over 410 million euros. Credit: John Milner/SOPA Images/ZUMA Wire/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/madrid-madrid-spain-20th-mar-2019-a-dia-supermarket-seen-in-central-madridshareholders-gave-their-support-to-russian-businessman-mikhail-fridman-spanish-supermarket-group-dias-biggest-shareholder-with-a-29-percent-stake-in-the-battle-for-control-of-the-company-fridmans-letter-on-fund-proposes-raising-500-million-euros-in-fresh-capital-values-dia-at-just-over-410-million-euros-credit-john-milnersopa-imageszuma-wirealamy-live-news-image241360106.htmlRMT0JW7P–Madrid, Madrid, Spain. 20th Mar, 2019. A 'Dia' supermarket seen in central Madrid.Shareholders gave their support to Russian businessman Mikhail Fridman, Spanish supermarket group DIA's biggest shareholder with a 29 percent stake, in the battle for control of the company. Fridman's Letter on fund, proposes raising 500 million euros in fresh capital, values DIA at just over 410 million euros. Credit: John Milner/SOPA Images/ZUMA Wire/Alamy Live News

The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/the-unlikely-marriage-between-a-rothschild-heir-and-liberation-the-left-wing-tabloid-born-in-the-rubble-of-frances-1968-student-riots-is-already-on-the-rocks-edouard-de-rothschild-who-last-year-paid-euro-20-million-us26-million-to-become-the-newspapers-biggest-shareholder-is-to-present-a-last-chance-turnaround-plan-to-staff-representatives-and-other-board-members-in-paris-france-on-september-27-2006-photo-by-mehdi-taamallahabacapresscom-image401729039.html

The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/the-unlikely-marriage-between-a-rothschild-heir-and-liberation-the-left-wing-tabloid-born-in-the-rubble-of-frances-1968-student-riots-is-already-on-the-rocks-edouard-de-rothschild-who-last-year-paid-euro-20-million-us26-million-to-become-the-newspapers-biggest-shareholder-is-to-present-a-last-chance-turnaround-plan-to-staff-representatives-and-other-board-members-in-paris-france-on-september-27-2006-photo-by-mehdi-taamallahabacapresscom-image401729039.htmlRF2E9G9DK–The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM

Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/erich-sixt-chairman-and-biggest-single-shareholder-of-car-rental-company-image67895209.html

Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/erich-sixt-chairman-and-biggest-single-shareholder-of-car-rental-company-image67895209.htmlRMDXCW0W–Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa

Tor Olav Troim, confidant Norwegian shipowner and TUI major shareholder J. Fredriksen, attends the TUI general meeting in Hanover, Germany, 09 February 2011. Europe's biggest travel group TUI reduced the season-common Q1 low due to increasing demand and decreasing costs and reports a loss of 46.4 million euro. Photo: Jochen Luebke Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-tor-olav-troim-confidant-norwegian-shipowner-and-tuimajor-shareholder-58111398.html

Tor Olav Troim, confidant Norwegian shipowner and TUI major shareholder J. Fredriksen, attends the TUI general meeting in Hanover, Germany, 09 February 2011. Europe's biggest travel group TUI reduced the season-common Q1 low due to increasing demand and decreasing costs and reports a loss of 46.4 million euro. Photo: Jochen Luebke Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-tor-olav-troim-confidant-norwegian-shipowner-and-tuimajor-shareholder-58111398.htmlRMDAF5K2–Tor Olav Troim, confidant Norwegian shipowner and TUI major shareholder J. Fredriksen, attends the TUI general meeting in Hanover, Germany, 09 February 2011. Europe's biggest travel group TUI reduced the season-common Q1 low due to increasing demand and decreasing costs and reports a loss of 46.4 million euro. Photo: Jochen Luebke

FILE PICS. 11th March, 2024. A Thames Water vehicle parked by the side of the road in Harefield in the London Borough of Hillingdon. Thames Water, the biggest water company in the UK with a dreadful record on sewage spills, will not be joining an industry wide £180m fund aimed at preventing sewage spills. It has been reported that Thames Water may run out of money by the end of April. Credit: Maureen McLean/Alamy Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-pics-11th-march-2024-a-thames-water-vehicle-parked-by-the-side-of-the-road-in-harefield-in-the-london-borough-of-hillingdon-thames-water-the-biggest-water-company-in-the-uk-with-a-dreadful-record-on-sewage-spills-will-not-be-joining-an-industry-wide-180m-fund-aimed-at-preventing-sewage-spills-it-has-been-reported-that-thames-water-may-run-out-of-money-by-the-end-of-april-credit-maureen-mcleanalamy-image599484880.html

FILE PICS. 11th March, 2024. A Thames Water vehicle parked by the side of the road in Harefield in the London Borough of Hillingdon. Thames Water, the biggest water company in the UK with a dreadful record on sewage spills, will not be joining an industry wide £180m fund aimed at preventing sewage spills. It has been reported that Thames Water may run out of money by the end of April. Credit: Maureen McLean/Alamy Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-pics-11th-march-2024-a-thames-water-vehicle-parked-by-the-side-of-the-road-in-harefield-in-the-london-borough-of-hillingdon-thames-water-the-biggest-water-company-in-the-uk-with-a-dreadful-record-on-sewage-spills-will-not-be-joining-an-industry-wide-180m-fund-aimed-at-preventing-sewage-spills-it-has-been-reported-that-thames-water-may-run-out-of-money-by-the-end-of-april-credit-maureen-mcleanalamy-image599484880.htmlRF2WR8W28–FILE PICS. 11th March, 2024. A Thames Water vehicle parked by the side of the road in Harefield in the London Borough of Hillingdon. Thames Water, the biggest water company in the UK with a dreadful record on sewage spills, will not be joining an industry wide £180m fund aimed at preventing sewage spills. It has been reported that Thames Water may run out of money by the end of April. Credit: Maureen McLean/Alamy

Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/enefit-and-elektrilevi-building-in-tallinn-enefit-is-the-biggest-energy-producer-and-one-of-the-biggest-producers-of-renewable-energy-in-the-baltics-image466732340.html

Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/enefit-and-elektrilevi-building-in-tallinn-enefit-is-the-biggest-energy-producer-and-one-of-the-biggest-producers-of-renewable-energy-in-the-baltics-image466732340.htmlRF2J39DT4–Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics.

Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/twitter-app-displayed-on-the-smartphone-with-finger-twitter-one-of-the-biggest-social-network-website-social-media-app-social-network-elon-musk-image227646476.html

Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/twitter-app-displayed-on-the-smartphone-with-finger-twitter-one-of-the-biggest-social-network-website-social-media-app-social-network-elon-musk-image227646476.htmlRFR6A5B8–Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk

Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/enefit-and-elektrilevi-building-in-tallinn-enefit-is-the-biggest-energy-producer-and-one-of-the-biggest-producers-of-renewable-energy-in-the-baltics-image417885504.html

Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/enefit-and-elektrilevi-building-in-tallinn-enefit-is-the-biggest-energy-producer-and-one-of-the-biggest-producers-of-renewable-energy-in-the-baltics-image417885504.htmlRF2F7T968–Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics.

Emilio Botin, chairman of Spain's biggest bank Santander Central Hispano attends a shareholders meeting in Santander, northern Spain. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-emilio-botin-chairman-of-spains-biggest-bank-santander-central-hispano-13179306.html

Emilio Botin, chairman of Spain's biggest bank Santander Central Hispano attends a shareholders meeting in Santander, northern Spain. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-emilio-botin-chairman-of-spains-biggest-bank-santander-central-hispano-13179306.htmlRMACKEPK–Emilio Botin, chairman of Spain's biggest bank Santander Central Hispano attends a shareholders meeting in Santander, northern Spain.

A woman reads a copy of The Economist magazine. Publishing group Pearson has agreed to sell its 50% stake in the Economist Group in a £469 million deal which will make Italy's Exor, controlled by the Agnelli dynasty, its biggest shareholder. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-woman-reads-a-copy-of-the-economist-magazine-publishing-group-pearson-108330506.html

A woman reads a copy of The Economist magazine. Publishing group Pearson has agreed to sell its 50% stake in the Economist Group in a £469 million deal which will make Italy's Exor, controlled by the Agnelli dynasty, its biggest shareholder. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-woman-reads-a-copy-of-the-economist-magazine-publishing-group-pearson-108330506.htmlRMG86TJJ–A woman reads a copy of The Economist magazine. Publishing group Pearson has agreed to sell its 50% stake in the Economist Group in a £469 million deal which will make Italy's Exor, controlled by the Agnelli dynasty, its biggest shareholder.

Owner, Manchester United manager Sir Alex Ferguson (right) leads his horse Rock of Gibraltar with jockey Johnny Murtagh to the winners enclosure after The Sagitta 2,000 Guineas Stakes at Newmarket Races. 18/11/03: Manchester United's biggest shareholder will 'vigorously contest' legal action by Sir Alex Ferguson over a racehorse, it has emerged. The Old Trafford manager has issued a writ against John Magnier demanding tens of millions of pounds in stud fees from Rock of Gibraltar which the pair co-own. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-owner-manchester-united-manager-sir-alex-ferguson-right-leads-his-107709140.html

Owner, Manchester United manager Sir Alex Ferguson (right) leads his horse Rock of Gibraltar with jockey Johnny Murtagh to the winners enclosure after The Sagitta 2,000 Guineas Stakes at Newmarket Races. 18/11/03: Manchester United's biggest shareholder will 'vigorously contest' legal action by Sir Alex Ferguson over a racehorse, it has emerged. The Old Trafford manager has issued a writ against John Magnier demanding tens of millions of pounds in stud fees from Rock of Gibraltar which the pair co-own. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-owner-manchester-united-manager-sir-alex-ferguson-right-leads-his-107709140.htmlRMG76G30–Owner, Manchester United manager Sir Alex Ferguson (right) leads his horse Rock of Gibraltar with jockey Johnny Murtagh to the winners enclosure after The Sagitta 2,000 Guineas Stakes at Newmarket Races. 18/11/03: Manchester United's biggest shareholder will 'vigorously contest' legal action by Sir Alex Ferguson over a racehorse, it has emerged. The Old Trafford manager has issued a writ against John Magnier demanding tens of millions of pounds in stud fees from Rock of Gibraltar which the pair co-own.

Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/chinese-investors-buy-french-soccer-club-ogc-nice-here-during-a-press-conference-chien-lee-chinese-american-entrepreneur-and-investor-and-the-founder-and-chairman-of-newcity-capital-a-private-investment-firm-and-now-chairman-and-biggest-shareholder-of-ogc-nice-football-club-image486344647.html

Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/chinese-investors-buy-french-soccer-club-ogc-nice-here-during-a-press-conference-chien-lee-chinese-american-entrepreneur-and-investor-and-the-founder-and-chairman-of-newcity-capital-a-private-investment-firm-and-now-chairman-and-biggest-shareholder-of-ogc-nice-football-club-image486344647.htmlRM2K76WFK–Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club.

Undated file photo of a Aston Martin badge. A massive fund controlled by Saudi Arabia's de facto leader will become the second biggest shareholder in British sports car manufacturer Aston Martin, the company has announced. The brand said it would raise between £500 million and £600 million from shareholders to pay down its debt.Issue date: Friday July 15, 2022. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/undated-file-photo-of-a-aston-martin-badge-a-massive-fund-controlled-by-saudi-arabias-de-facto-leader-will-become-the-second-biggest-shareholder-in-british-sports-car-manufacturer-aston-martin-the-company-has-announced-the-brand-said-it-would-raise-between-500-million-and-600-million-from-shareholders-to-pay-down-its-debtissue-date-friday-july-15-2022-image475230572.html

Undated file photo of a Aston Martin badge. A massive fund controlled by Saudi Arabia's de facto leader will become the second biggest shareholder in British sports car manufacturer Aston Martin, the company has announced. The brand said it would raise between £500 million and £600 million from shareholders to pay down its debt.Issue date: Friday July 15, 2022. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/undated-file-photo-of-a-aston-martin-badge-a-massive-fund-controlled-by-saudi-arabias-de-facto-leader-will-become-the-second-biggest-shareholder-in-british-sports-car-manufacturer-aston-martin-the-company-has-announced-the-brand-said-it-would-raise-between-500-million-and-600-million-from-shareholders-to-pay-down-its-debtissue-date-friday-july-15-2022-image475230572.htmlRM2JH4HCC–Undated file photo of a Aston Martin badge. A massive fund controlled by Saudi Arabia's de facto leader will become the second biggest shareholder in British sports car manufacturer Aston Martin, the company has announced. The brand said it would raise between £500 million and £600 million from shareholders to pay down its debt.Issue date: Friday July 15, 2022.

Madrid, Madrid, Spain. 20th Mar, 2019. A 'Dia' supermarket seen in central Madrid.Shareholders gave their support to Russian businessman Mikhail Fridman, Spanish supermarket group DIA's biggest shareholder with a 29 percent stake, in the battle for control of the company. Fridman's Letter on fund, proposes raising 500 million euros in fresh capital, values DIA at just over 410 million euros. Credit: John Milner/SOPA Images/ZUMA Wire/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/madrid-madrid-spain-20th-mar-2019-a-dia-supermarket-seen-in-central-madridshareholders-gave-their-support-to-russian-businessman-mikhail-fridman-spanish-supermarket-group-dias-biggest-shareholder-with-a-29-percent-stake-in-the-battle-for-control-of-the-company-fridmans-letter-on-fund-proposes-raising-500-million-euros-in-fresh-capital-values-dia-at-just-over-410-million-euros-credit-john-milnersopa-imageszuma-wirealamy-live-news-image241360115.html

Madrid, Madrid, Spain. 20th Mar, 2019. A 'Dia' supermarket seen in central Madrid.Shareholders gave their support to Russian businessman Mikhail Fridman, Spanish supermarket group DIA's biggest shareholder with a 29 percent stake, in the battle for control of the company. Fridman's Letter on fund, proposes raising 500 million euros in fresh capital, values DIA at just over 410 million euros. Credit: John Milner/SOPA Images/ZUMA Wire/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/madrid-madrid-spain-20th-mar-2019-a-dia-supermarket-seen-in-central-madridshareholders-gave-their-support-to-russian-businessman-mikhail-fridman-spanish-supermarket-group-dias-biggest-shareholder-with-a-29-percent-stake-in-the-battle-for-control-of-the-company-fridmans-letter-on-fund-proposes-raising-500-million-euros-in-fresh-capital-values-dia-at-just-over-410-million-euros-credit-john-milnersopa-imageszuma-wirealamy-live-news-image241360115.htmlRMT0JW83–Madrid, Madrid, Spain. 20th Mar, 2019. A 'Dia' supermarket seen in central Madrid.Shareholders gave their support to Russian businessman Mikhail Fridman, Spanish supermarket group DIA's biggest shareholder with a 29 percent stake, in the battle for control of the company. Fridman's Letter on fund, proposes raising 500 million euros in fresh capital, values DIA at just over 410 million euros. Credit: John Milner/SOPA Images/ZUMA Wire/Alamy Live News

A shareholder browses at the Annual General Meeting notes before going in to the 178th AGM of Standard Life, at the Edinburgh International Conference Centre, Edinburgh. The board of Europe's biggest mutual life insurer was facing policyholders today for the first time since it announced plans to demutualise. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-shareholder-browses-at-the-annual-general-meeting-notes-before-going-107519096.html

A shareholder browses at the Annual General Meeting notes before going in to the 178th AGM of Standard Life, at the Edinburgh International Conference Centre, Edinburgh. The board of Europe's biggest mutual life insurer was facing policyholders today for the first time since it announced plans to demutualise. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-shareholder-browses-at-the-annual-general-meeting-notes-before-going-107519096.htmlRMG6WWKM–A shareholder browses at the Annual General Meeting notes before going in to the 178th AGM of Standard Life, at the Edinburgh International Conference Centre, Edinburgh. The board of Europe's biggest mutual life insurer was facing policyholders today for the first time since it announced plans to demutualise.

The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/the-unlikely-marriage-between-a-rothschild-heir-and-liberation-the-left-wing-tabloid-born-in-the-rubble-of-frances-1968-student-riots-is-already-on-the-rocks-edouard-de-rothschild-who-last-year-paid-euro-20-million-us26-million-to-become-the-newspapers-biggest-shareholder-is-to-present-a-last-chance-turnaround-plan-to-staff-representatives-and-other-board-members-in-paris-france-on-september-27-2006-photo-by-mehdi-taamallahabacapresscom-image401729038.html

The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/the-unlikely-marriage-between-a-rothschild-heir-and-liberation-the-left-wing-tabloid-born-in-the-rubble-of-frances-1968-student-riots-is-already-on-the-rocks-edouard-de-rothschild-who-last-year-paid-euro-20-million-us26-million-to-become-the-newspapers-biggest-shareholder-is-to-present-a-last-chance-turnaround-plan-to-staff-representatives-and-other-board-members-in-paris-france-on-september-27-2006-photo-by-mehdi-taamallahabacapresscom-image401729038.htmlRF2E9G9DJ–The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM

The first of two Short Skyvan light transports for the Greek national airline Olympic Airways flies over the new £7million building dock and £1.25million gantry crane at Harland and Wolff's shipyard in Belfast. Greek shipping tycoon Aristotle Onassis is the biggest shareholder in Harland and Wolff and sole owner of Olympic Airways. His ship and Skyvan purchases are worth over £18million to Belfast's economy. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-the-first-of-two-short-skyvan-light-transports-for-the-greek-national-132506407.html

The first of two Short Skyvan light transports for the Greek national airline Olympic Airways flies over the new £7million building dock and £1.25million gantry crane at Harland and Wolff's shipyard in Belfast. Greek shipping tycoon Aristotle Onassis is the biggest shareholder in Harland and Wolff and sole owner of Olympic Airways. His ship and Skyvan purchases are worth over £18million to Belfast's economy. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-the-first-of-two-short-skyvan-light-transports-for-the-greek-national-132506407.htmlRMHKG57K–The first of two Short Skyvan light transports for the Greek national airline Olympic Airways flies over the new £7million building dock and £1.25million gantry crane at Harland and Wolff's shipyard in Belfast. Greek shipping tycoon Aristotle Onassis is the biggest shareholder in Harland and Wolff and sole owner of Olympic Airways. His ship and Skyvan purchases are worth over £18million to Belfast's economy.

Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/erich-sixt-chairman-and-biggest-single-shareholder-of-car-rental-company-image67895210.html

Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/erich-sixt-chairman-and-biggest-single-shareholder-of-car-rental-company-image67895210.htmlRMDXCW0X–Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa

A shareholder browses at the Annual General Meeting notes before going in to the 178th AGM of Standard Life, at the Edinburgh International Conference Centre, Edinburgh. The board of Europe's biggest mutual life insurer was facing policyholders today for the first time since it announced plans to demutualise. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-shareholder-browses-at-the-annual-general-meeting-notes-before-going-107519095.html

A shareholder browses at the Annual General Meeting notes before going in to the 178th AGM of Standard Life, at the Edinburgh International Conference Centre, Edinburgh. The board of Europe's biggest mutual life insurer was facing policyholders today for the first time since it announced plans to demutualise. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-a-shareholder-browses-at-the-annual-general-meeting-notes-before-going-107519095.htmlRMG6WWKK–A shareholder browses at the Annual General Meeting notes before going in to the 178th AGM of Standard Life, at the Edinburgh International Conference Centre, Edinburgh. The board of Europe's biggest mutual life insurer was facing policyholders today for the first time since it announced plans to demutualise.

FILE PICS. 11th March, 2024. A Thames Water vehicle parked by the side of the road in Harefield in the London Borough of Hillingdon. Thames Water, the biggest water company in the UK with a dreadful record on sewage spills, will not be joining an industry wide £180m fund aimed at preventing sewage spills. It has been reported that Thames Water may run out of money by the end of April. Credit: Maureen McLean/Alamy Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-pics-11th-march-2024-a-thames-water-vehicle-parked-by-the-side-of-the-road-in-harefield-in-the-london-borough-of-hillingdon-thames-water-the-biggest-water-company-in-the-uk-with-a-dreadful-record-on-sewage-spills-will-not-be-joining-an-industry-wide-180m-fund-aimed-at-preventing-sewage-spills-it-has-been-reported-that-thames-water-may-run-out-of-money-by-the-end-of-april-credit-maureen-mcleanalamy-image599484997.html

FILE PICS. 11th March, 2024. A Thames Water vehicle parked by the side of the road in Harefield in the London Borough of Hillingdon. Thames Water, the biggest water company in the UK with a dreadful record on sewage spills, will not be joining an industry wide £180m fund aimed at preventing sewage spills. It has been reported that Thames Water may run out of money by the end of April. Credit: Maureen McLean/Alamy Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-pics-11th-march-2024-a-thames-water-vehicle-parked-by-the-side-of-the-road-in-harefield-in-the-london-borough-of-hillingdon-thames-water-the-biggest-water-company-in-the-uk-with-a-dreadful-record-on-sewage-spills-will-not-be-joining-an-industry-wide-180m-fund-aimed-at-preventing-sewage-spills-it-has-been-reported-that-thames-water-may-run-out-of-money-by-the-end-of-april-credit-maureen-mcleanalamy-image599484997.htmlRF2WR8W6D–FILE PICS. 11th March, 2024. A Thames Water vehicle parked by the side of the road in Harefield in the London Borough of Hillingdon. Thames Water, the biggest water company in the UK with a dreadful record on sewage spills, will not be joining an industry wide £180m fund aimed at preventing sewage spills. It has been reported that Thames Water may run out of money by the end of April. Credit: Maureen McLean/Alamy

File photo dated 03/08/09 of a HSBC branch in London, as they have vowed to return shareholder dividend payouts to pre-pandemic levels 'as soon as possible' as it comes under pressure from its biggest investor to break up the group. Chief executive Noel Quinn made the pledge as he seeks to head off calls from China's Ping An Insurance Group which owns around 9.2% of HSBC's shares to spin off its burgeoning Asian arm from the UK business. Issue date: Monday August 1, 2022. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-photo-dated-030809-of-a-hsbc-branch-in-london-as-they-have-vowed-to-return-shareholder-dividend-payouts-to-pre-pandemic-levels-as-soon-as-possible-as-it-comes-under-pressure-from-its-biggest-investor-to-break-up-the-group-chief-executive-noel-quinn-made-the-pledge-as-he-seeks-to-head-off-calls-from-chinas-ping-an-insurance-group-which-owns-around-92-of-hsbcs-shares-to-spin-off-its-burgeoning-asian-arm-from-the-uk-business-issue-date-monday-august-1-2022-image476591534.html

File photo dated 03/08/09 of a HSBC branch in London, as they have vowed to return shareholder dividend payouts to pre-pandemic levels 'as soon as possible' as it comes under pressure from its biggest investor to break up the group. Chief executive Noel Quinn made the pledge as he seeks to head off calls from China's Ping An Insurance Group which owns around 9.2% of HSBC's shares to spin off its burgeoning Asian arm from the UK business. Issue date: Monday August 1, 2022. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/file-photo-dated-030809-of-a-hsbc-branch-in-london-as-they-have-vowed-to-return-shareholder-dividend-payouts-to-pre-pandemic-levels-as-soon-as-possible-as-it-comes-under-pressure-from-its-biggest-investor-to-break-up-the-group-chief-executive-noel-quinn-made-the-pledge-as-he-seeks-to-head-off-calls-from-chinas-ping-an-insurance-group-which-owns-around-92-of-hsbcs-shares-to-spin-off-its-burgeoning-asian-arm-from-the-uk-business-issue-date-monday-august-1-2022-image476591534.htmlRM2JKAHA6–File photo dated 03/08/09 of a HSBC branch in London, as they have vowed to return shareholder dividend payouts to pre-pandemic levels 'as soon as possible' as it comes under pressure from its biggest investor to break up the group. Chief executive Noel Quinn made the pledge as he seeks to head off calls from China's Ping An Insurance Group which owns around 9.2% of HSBC's shares to spin off its burgeoning Asian arm from the UK business. Issue date: Monday August 1, 2022.

Eton, Windsor, UK. 28th March, 2024. A Thames Water van drives through floodwater on a country road in Eton, Berkshire this morning. The possibility of Thames Water being nationalised has increased greatly today as shareholders in the UK's biggest water company have refuse to give £500m in emergency funding. The CEO of Thames Water, Chris Weston has reportedly said that if funding investment cannot be found by the end of 2024 that there was a prospect of the company going into special administration. Credit: Maureen McLean/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/eton-windsor-uk-28th-march-2024-a-thames-water-van-drives-through-floodwater-on-a-country-road-in-eton-berkshire-this-morning-the-possibility-of-thames-water-being-nationalised-has-increased-greatly-today-as-shareholders-in-the-uks-biggest-water-company-have-refuse-to-give-500m-in-emergency-funding-the-ceo-of-thames-water-chris-weston-has-reportedly-said-that-if-funding-investment-cannot-be-found-by-the-end-of-2024-that-there-was-a-prospect-of-the-company-going-into-special-administration-credit-maureen-mcleanalamy-live-news-image601281259.html

Eton, Windsor, UK. 28th March, 2024. A Thames Water van drives through floodwater on a country road in Eton, Berkshire this morning. The possibility of Thames Water being nationalised has increased greatly today as shareholders in the UK's biggest water company have refuse to give £500m in emergency funding. The CEO of Thames Water, Chris Weston has reportedly said that if funding investment cannot be found by the end of 2024 that there was a prospect of the company going into special administration. Credit: Maureen McLean/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/eton-windsor-uk-28th-march-2024-a-thames-water-van-drives-through-floodwater-on-a-country-road-in-eton-berkshire-this-morning-the-possibility-of-thames-water-being-nationalised-has-increased-greatly-today-as-shareholders-in-the-uks-biggest-water-company-have-refuse-to-give-500m-in-emergency-funding-the-ceo-of-thames-water-chris-weston-has-reportedly-said-that-if-funding-investment-cannot-be-found-by-the-end-of-2024-that-there-was-a-prospect-of-the-company-going-into-special-administration-credit-maureen-mcleanalamy-live-news-image601281259.htmlRM2WX6MAK–Eton, Windsor, UK. 28th March, 2024. A Thames Water van drives through floodwater on a country road in Eton, Berkshire this morning. The possibility of Thames Water being nationalised has increased greatly today as shareholders in the UK's biggest water company have refuse to give £500m in emergency funding. The CEO of Thames Water, Chris Weston has reportedly said that if funding investment cannot be found by the end of 2024 that there was a prospect of the company going into special administration. Credit: Maureen McLean/Alamy Live News

Undated file photo of signage for Boohoo. Mike Ashley's Frasers Group has upped its stake in fast fashion firm Boohoo once again, less than two weeks after becoming its biggest single shareholder. The owner of Sports Direct and Flannels brands increased its shareholding in Boohoo to 15.1% from 13.4%, according to filings. Issue date: Monday October 16, 2023. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/undated-file-photo-of-signage-for-boohoo-mike-ashleys-frasers-group-has-upped-its-stake-in-fast-fashion-firm-boohoo-once-again-less-than-two-weeks-after-becoming-its-biggest-single-shareholder-the-owner-of-sports-direct-and-flannels-brands-increased-its-shareholding-in-boohoo-to-151-from-134-according-to-filings-issue-date-monday-october-16-2023-image569154315.html

Undated file photo of signage for Boohoo. Mike Ashley's Frasers Group has upped its stake in fast fashion firm Boohoo once again, less than two weeks after becoming its biggest single shareholder. The owner of Sports Direct and Flannels brands increased its shareholding in Boohoo to 15.1% from 13.4%, according to filings. Issue date: Monday October 16, 2023. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/undated-file-photo-of-signage-for-boohoo-mike-ashleys-frasers-group-has-upped-its-stake-in-fast-fashion-firm-boohoo-once-again-less-than-two-weeks-after-becoming-its-biggest-single-shareholder-the-owner-of-sports-direct-and-flannels-brands-increased-its-shareholding-in-boohoo-to-151-from-134-according-to-filings-issue-date-monday-october-16-2023-image569154315.htmlRM2T1Y63R–Undated file photo of signage for Boohoo. Mike Ashley's Frasers Group has upped its stake in fast fashion firm Boohoo once again, less than two weeks after becoming its biggest single shareholder. The owner of Sports Direct and Flannels brands increased its shareholding in Boohoo to 15.1% from 13.4%, according to filings. Issue date: Monday October 16, 2023.

Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/enefit-and-elektrilevi-building-in-tallinn-enefit-is-the-biggest-energy-producer-and-one-of-the-biggest-producers-of-renewable-energy-in-the-baltics-image417885517.html

Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/enefit-and-elektrilevi-building-in-tallinn-enefit-is-the-biggest-energy-producer-and-one-of-the-biggest-producers-of-renewable-energy-in-the-baltics-image417885517.htmlRF2F7T96N–Enefit and Elektrilevi building in Tallinn. Enefit is the biggest energy producer and one of the biggest producers of renewable energy in the Baltics.

The Economist magazine Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-the-economist-magazine-108330508.html

The Economist magazine Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-the-economist-magazine-108330508.htmlRMG86TJM–The Economist magazine

Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/twitter-app-displayed-on-the-smartphone-with-finger-twitter-one-of-the-biggest-social-network-website-social-media-app-social-network-elon-musk-image227646404.html

Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/twitter-app-displayed-on-the-smartphone-with-finger-twitter-one-of-the-biggest-social-network-website-social-media-app-social-network-elon-musk-image227646404.htmlRFR6A58M–Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk

A file Picture of The group headquarters of glass makers Pilkington . The Glass maker Pilkington rejected a takeover approach today Thursday 3 Novenmber2005 from its biggest shareholder on the grounds that it was too low.Earlier this week, Pilkington and Japanese firm Nippon confirmed they were in preliminary discussions over a cash offer for the companyNippon owns nearly 20% of Pilkington and it was thought it could generate savings from combining its UK subsidiary NGF Europe with the headquarters of Pilkington as they are both based in St Helens. Pilkington said today that the proposed off Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/a-file-picture-of-the-group-headquarters-of-glass-makers-pilkington-the-glass-maker-pilkington-rejected-a-takeover-approach-today-thursday-3-novenmber2005-from-its-biggest-shareholder-on-the-grounds-that-it-was-too-lowearlier-this-week-pilkington-and-japanese-firm-nippon-confirmed-they-were-in-preliminary-discussions-over-a-cash-offer-for-the-companynippon-owns-nearly-20-of-pilkington-and-it-was-thought-it-could-generate-savings-from-combining-its-uk-subsidiary-ngf-europe-with-the-headquarters-of-pilkington-as-they-are-both-based-in-st-helens-pilkington-said-today-that-the-proposed-off-image380572063.html

A file Picture of The group headquarters of glass makers Pilkington . The Glass maker Pilkington rejected a takeover approach today Thursday 3 Novenmber2005 from its biggest shareholder on the grounds that it was too low.Earlier this week, Pilkington and Japanese firm Nippon confirmed they were in preliminary discussions over a cash offer for the companyNippon owns nearly 20% of Pilkington and it was thought it could generate savings from combining its UK subsidiary NGF Europe with the headquarters of Pilkington as they are both based in St Helens. Pilkington said today that the proposed off Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/a-file-picture-of-the-group-headquarters-of-glass-makers-pilkington-the-glass-maker-pilkington-rejected-a-takeover-approach-today-thursday-3-novenmber2005-from-its-biggest-shareholder-on-the-grounds-that-it-was-too-lowearlier-this-week-pilkington-and-japanese-firm-nippon-confirmed-they-were-in-preliminary-discussions-over-a-cash-offer-for-the-companynippon-owns-nearly-20-of-pilkington-and-it-was-thought-it-could-generate-savings-from-combining-its-uk-subsidiary-ngf-europe-with-the-headquarters-of-pilkington-as-they-are-both-based-in-st-helens-pilkington-said-today-that-the-proposed-off-image380572063.htmlRM2D34FFB– A file Picture of The group headquarters of glass makers Pilkington . The Glass maker Pilkington rejected a takeover approach today Thursday 3 Novenmber2005 from its biggest shareholder on the grounds that it was too low.Earlier this week, Pilkington and Japanese firm Nippon confirmed they were in preliminary discussions over a cash offer for the companyNippon owns nearly 20% of Pilkington and it was thought it could generate savings from combining its UK subsidiary NGF Europe with the headquarters of Pilkington as they are both based in St Helens. Pilkington said today that the proposed off

Emilio Botin, chairman of Spain's biggest bank Santander Central Hispano attends a shareholders meeting in Santander, northern Spain. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-emilio-botin-chairman-of-spains-biggest-bank-santander-central-hispano-13179329.html

Emilio Botin, chairman of Spain's biggest bank Santander Central Hispano attends a shareholders meeting in Santander, northern Spain. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-emilio-botin-chairman-of-spains-biggest-bank-santander-central-hispano-13179329.htmlRMACKETJ–Emilio Botin, chairman of Spain's biggest bank Santander Central Hispano attends a shareholders meeting in Santander, northern Spain.

178th AGM of Standard Life Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-178th-agm-of-standard-life-107519098.html

178th AGM of Standard Life Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-178th-agm-of-standard-life-107519098.htmlRMG6WWKP–178th AGM of Standard Life

Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/chinese-investors-buy-french-soccer-club-ogc-nice-here-during-a-press-conference-chien-lee-chinese-american-entrepreneur-and-investor-and-the-founder-and-chairman-of-newcity-capital-a-private-investment-firm-and-now-chairman-and-biggest-shareholder-of-ogc-nice-football-club-image486344661.html

Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/chinese-investors-buy-french-soccer-club-ogc-nice-here-during-a-press-conference-chien-lee-chinese-american-entrepreneur-and-investor-and-the-founder-and-chairman-of-newcity-capital-a-private-investment-firm-and-now-chairman-and-biggest-shareholder-of-ogc-nice-football-club-image486344661.htmlRM2K76WG5–Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club.

Marconi & Cambridge Partnership Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-marconi-cambridge-partnership-106334139.html

Marconi & Cambridge Partnership Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-marconi-cambridge-partnership-106334139.htmlRMG4YX7R–Marconi & Cambridge Partnership

Vodafone Government contract Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-vodafone-government-contract-106426235.html

Vodafone Government contract Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-vodafone-government-contract-106426235.htmlRMG543MY–Vodafone Government contract

The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/the-unlikely-marriage-between-a-rothschild-heir-and-liberation-the-left-wing-tabloid-born-in-the-rubble-of-frances-1968-student-riots-is-already-on-the-rocks-edouard-de-rothschild-who-last-year-paid-euro-20-million-us26-million-to-become-the-newspapers-biggest-shareholder-is-to-present-a-last-chance-turnaround-plan-to-staff-representatives-and-other-board-members-in-paris-france-on-september-27-2006-photo-by-mehdi-taamallahabacapresscom-image401729049.html

The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/the-unlikely-marriage-between-a-rothschild-heir-and-liberation-the-left-wing-tabloid-born-in-the-rubble-of-frances-1968-student-riots-is-already-on-the-rocks-edouard-de-rothschild-who-last-year-paid-euro-20-million-us26-million-to-become-the-newspapers-biggest-shareholder-is-to-present-a-last-chance-turnaround-plan-to-staff-representatives-and-other-board-members-in-paris-france-on-september-27-2006-photo-by-mehdi-taamallahabacapresscom-image401729049.htmlRF2E9G9E1–The unlikely marriage between a Rothschild heir and Liberation, the left-wing tabloid born in the rubble of France's 1968 student riots, is already on the rocks. Edouard de Rothschild, who last year paid euro 20 million (US$26 million) to become the newspaper's biggest shareholder, is to present a 'last chance' turnaround plan to staff representatives and other board members in Paris, France, on September 27, 2006. Photo by Mehdi Taamallah/ABACAPRESS.COM

Bland British Telecom Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-bland-british-telecom-106607234.html

Bland British Telecom Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/stock-photo-bland-british-telecom-106607234.htmlRMG5CAH6–Bland British Telecom

Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/erich-sixt-chairman-and-biggest-single-shareholder-of-car-rental-company-image67895208.html

Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/erich-sixt-chairman-and-biggest-single-shareholder-of-car-rental-company-image67895208.htmlRMDXCW0T–Erich Sixt, chairman and biggest single shareholder of car rental company Sixt speaks during the annual balance press conference in Munich, Germany, 24 March 2014. Last year's profits of Germany's biggest car rental company were higher than expected. Photo: SVEN HOPPE/dpa

Eton, Windsor, UK. 28th March, 2024. A Thames Water van drives through floodwater on a country road in Eton, Berkshire this morning. The possibility of Thames Water being nationalised has increased greatly today as shareholders in the UK's biggest water company have refuse to give £500m in emergency funding. The CEO of Thames Water, Chris Weston has reportedly said that if funding investment cannot be found by the end of 2024 that there was a prospect of the company going into special administration. Credit: Maureen McLean/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/eton-windsor-uk-28th-march-2024-a-thames-water-van-drives-through-floodwater-on-a-country-road-in-eton-berkshire-this-morning-the-possibility-of-thames-water-being-nationalised-has-increased-greatly-today-as-shareholders-in-the-uks-biggest-water-company-have-refuse-to-give-500m-in-emergency-funding-the-ceo-of-thames-water-chris-weston-has-reportedly-said-that-if-funding-investment-cannot-be-found-by-the-end-of-2024-that-there-was-a-prospect-of-the-company-going-into-special-administration-credit-maureen-mcleanalamy-live-news-image601281231.html

Eton, Windsor, UK. 28th March, 2024. A Thames Water van drives through floodwater on a country road in Eton, Berkshire this morning. The possibility of Thames Water being nationalised has increased greatly today as shareholders in the UK's biggest water company have refuse to give £500m in emergency funding. The CEO of Thames Water, Chris Weston has reportedly said that if funding investment cannot be found by the end of 2024 that there was a prospect of the company going into special administration. Credit: Maureen McLean/Alamy Live News Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/eton-windsor-uk-28th-march-2024-a-thames-water-van-drives-through-floodwater-on-a-country-road-in-eton-berkshire-this-morning-the-possibility-of-thames-water-being-nationalised-has-increased-greatly-today-as-shareholders-in-the-uks-biggest-water-company-have-refuse-to-give-500m-in-emergency-funding-the-ceo-of-thames-water-chris-weston-has-reportedly-said-that-if-funding-investment-cannot-be-found-by-the-end-of-2024-that-there-was-a-prospect-of-the-company-going-into-special-administration-credit-maureen-mcleanalamy-live-news-image601281231.htmlRM2WX6M9K–Eton, Windsor, UK. 28th March, 2024. A Thames Water van drives through floodwater on a country road in Eton, Berkshire this morning. The possibility of Thames Water being nationalised has increased greatly today as shareholders in the UK's biggest water company have refuse to give £500m in emergency funding. The CEO of Thames Water, Chris Weston has reportedly said that if funding investment cannot be found by the end of 2024 that there was a prospect of the company going into special administration. Credit: Maureen McLean/Alamy Live News

Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/twitter-app-displayed-on-the-smartphone-with-finger-twitter-one-of-the-biggest-social-network-website-social-media-app-social-network-elon-musk-image227646418.html

Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/twitter-app-displayed-on-the-smartphone-with-finger-twitter-one-of-the-biggest-social-network-website-social-media-app-social-network-elon-musk-image227646418.htmlRFR6A596–Twitter app displayed on the smartphone with finger. Twitter one of the biggest social network website. Social media app. Social network. Elon Musk

Chinese Investors Buy French Soccer Club OGC Nice. Here, during a press conference : Chien Lee, Chinese-American entrepreneur and investor and the founder and Chairman of NewCity Capital, a private investment firm, and now Chairman and biggest shareholder of OGC Nice Football Club. Stock Photohttps://www.alamy.com/image-license-details/?v=1https://www.alamy.com/chinese-investors-buy-french-soccer-club-ogc-nice-here-during-a-press-conference-chien-lee-chinese-american-entrepreneur-and-investor-and-the-founder-and-chairman-of-newcity-capital-a-private-investment-firm-and-now-chairman-and-biggest-shareholder-of-ogc-nice-football-club-image486344668.html